Headlines

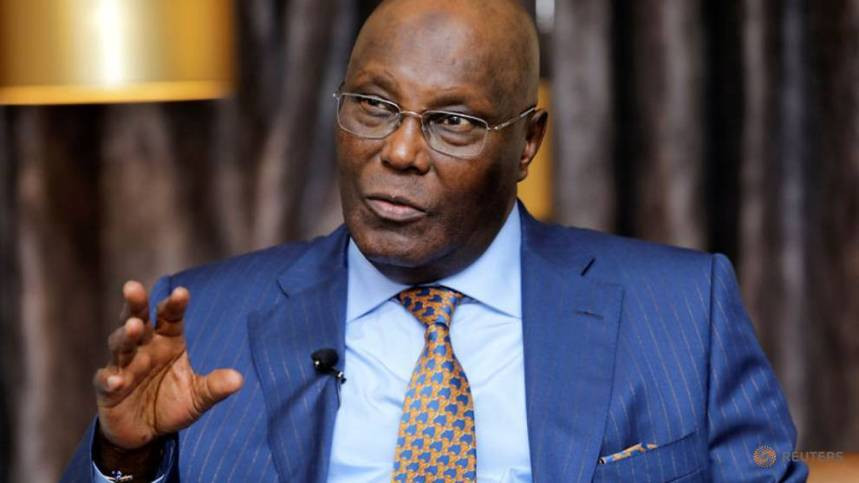

Atiku Tasks PDP Members on Reclaiming Party’s Lost Glory

Former Vice President and presidential candidate of the Peoples Democratic Party in the 2023 election, Atiku Abubakar, has called on leaders and stakeholders of the party to reflect on prevailing challenges and come up with strategies that will enable the PDP to take its dominant place once again.

Atiku gave the charge in Abuja on Thursday at a reception organized for returning and newly elected governors on the platform of the party.

“We have a number of challenges. We started as a dominant political party in 1999, but since then, we have been receding. It is time to take stock and find out why we are receding and how we can make sure that our position as the leading political party in the country can be regained.

“This is a very important challenge that requires a whole day seminar so that we can as a party regain our eminent position in the country,” he said.

The former vice president also urged party leaders and members alike to be hopeful of the favourable outcome in the presidential election petition.

“We all know that the PDP did not lose the last election. We should be determined and focus on retrieving our mandate that has been stolen,” Atiku said.

Earlier in his opening address, acting National Chairman of the party, Umar Damagum, said Nigerians are resolute in seeing justice done to the petition filed by the PDP at the Presidential Election Petition Tribunal.

“The only solution for the common man is to have a just adjudication in the election petition,” he said, stressing that issues affecting the party were being addressed by the National Working Committee.

Also speaking, former Vice President and Chairman of the occasion, Namadi Sambo, called for togetherness, lamenting the Ill treatment being meted out to some PDP members, particularly in his home state of Kaduna.

“What is happening in some states today is very unfortunate. What is happening in Kaduna State today where people are being suspended from the party without due process, is worrisome.

“I want to seize this opportunity to publicly ask the acting National Chairman to look into what is happening in Kaduna State because all the ingredients for trouble and problem in the party are taking place,” he said.

Chairman of the PDP Governors Forum and Governor of Sokoto State, Aminu Tambuwal, described the event as a moment of joy, “a moment for learning and support”, adding that “the mandate freely given to our party and candidate will be restored by the court”.

Speaking on the theme, “Good governance at the sub-national level: Issues, perspectives, expectations and outcomes”, the keynote speaker, Mudal Lawal, tasked the returning and governors-elect to put emphasis on performance management, fiscal performance indicators, fiscal resilience and devolution of powers.

He also urged the governors to prioritize appointing the right people into offices, stressing that with the right appointees, policies and programmes of government would run with ease.

“Appoint the right people. You must be resilient in your ability to meet operational costs with your Internally Generated Revenue. Equally important is a robust monitoring and evaluation system,” he said.

Lawal further enjoined the governors to be prudent in the management of resources, noting that debt to service ratio is becoming an issue of governance in public administration in the country over the past couple of years.

At the event were newly elected Governors of Delta State, Sheriff Oborevwori, his Plateau and Zamfara States counterparts, Caleb Mutfwang and Dauda Lawal; Taraba State Governor-elect, Agbu Kefas as well as Peter Mbah of Enugu State.

The Rivers State Governor-elect, Simi Fubara was absent at the event.

Meanwhile, PDP G-5 boycotted the reception event organized for new and returning PDP Governors.

The event put together by the PDP Governors Forum was expected to bring together for the first time, Atiku and Governors Nyesom Wike, Ifeanyi Ugwuanyi, Samuel Ortom, Okezie Ikpeazu and Seyi Makinde of Rivers, Enugu, Benue, Abia and Oyo States respectively.

The five governors allegedly worked against the PDP in the February 25 presidential election, a development that contributed in part to the defeat suffered by the PDP.

None of the five governors sent a representative to the well-attended event or word explaining their absence.

The Punch

Headlines

Court Empowers Tinubu to Implement New Tax Law Effective Jan 1

An Abuja High Court has cleared the way for the implementation of Nigeria’s new tax regime scheduled to commence on January 1, 2026, dismissing a suit seeking to halt the programme.

The ruling gives the Federal government, the Federal Inland Revenue Service (FIRS) and the National Assembly full legal backing to proceed with the take-off of the new tax laws.

The suit was filed by the Incorporated Trustees of African Initiative for Abuse of Public Trustees, which dragged the Federal Republic of Nigeria, the President, the Attorney-General of the Federation, the President of the Senate, Speaker of the House of Representatives and the National Assembly before the court over alleged discrepancies in the recently enacted tax laws.

In an ex-parte motion, the plaintiff sought an interim injunction restraining the Federal Government, FIRS, the National Assembly and related agencies from implementing or enforcing the provisions of the Nigeria Tax Act, 2025; Nigeria Tax Administration Act, 2025; Nigeria Revenue Service (Establishment) Act, 2025; and the Joint Revenue Board of Nigeria (Establishment) Act, 2025, pending the determination of the substantive suit.

The group also asked the court to restrain the President from implementing the laws in any part of the federation pending the hearing of its motion on notice.

However, in a ruling delivered on Tuesday, Justice Kawu struck out the application, holding that it lacked merit and failed to establish sufficient legal grounds to warrant the grant of the reliefs sought.

The court ruled that the plaintiffs did not demonstrate how the implementation of the new tax laws would occasion irreparable harm or violate any provision of the Constitution, stressing that matters of fiscal policy and economic reforms fall squarely within the powers of government.

Justice Kawu further held that once a law has been duly enacted and gazetted, any alleged errors or controversies can only be addressed through legislative amendment or a substantive court order, noting that disagreements over tax laws cannot stop the implementation of an existing law.

Consequently, the court affirmed that there was no legal impediment to the commencement of the new tax regime and directed that implementation should proceed as scheduled from January 1, 2026.

The new tax regime is anchored on four landmark tax reform bills signed into law in 2025 as part of the Federal Government’s broader fiscal and economic reform agenda aimed at boosting revenue, simplifying the tax system and reducing leakages.

The laws — the Nigeria Tax Act, 2025, Nigeria Tax Administration Act, 2025, Nigeria Revenue Service (Establishment) Act, 2025, and the Joint Revenue Board of Nigeria (Establishment) Act, 2025 — consolidate and replace several existing tax statutes, including laws governing companies income tax, personal income tax, value added tax, capital gains tax and stamp duties.

Key elements of the reforms include the harmonisation of multiple taxes into a more streamlined framework, expansion of the tax base, protection for low-income earners and small businesses, and the introduction of modern, technology-driven tax administration systems such as digital filing and electronic compliance monitoring.

The reforms also provide for the restructuring of federal tax administration, including the creation of the Nigeria Revenue Service, to strengthen efficiency, coordination and revenue collection across government levels.

While the Federal government has described the reforms as critical to stabilising public finances and funding infrastructure and social services, the laws have generated intense public debate, with some civil society groups and political actors alleging discrepancies between the versions passed by the National Assembly and those later gazetted.

These concerns sparked calls for suspension, re-gazetting and legal action, culminating in the suit dismissed by the Abuja High Court.

Reacting to the judgment, stakeholders described the ruling as a major boost for the reforms, saying it has removed all legal obstacles that could have delayed the implementation of the new tax framework.

Headlines

Peter Obi Officially Dumps Labour Party, Defects to ADC

Former governor of Anambra State, presidential candidate of the Labour Party (LP) in the 2023 election, Mr. Peter Obi, has officially defected to the coalition-backed African Democratic Congress (ADC).

Obi announced the decision on Tuesday at an event held at the Nike Lake Resort, Enugu.

“We are ending this year with the hope that in 2026 we will begin a rescue journey,” Obi said.

The National Chairman of the ADC, David Mark, was among the attendees.

Headlines

US Lawmaker Seeks More Airstrikes in Nigeria, Insists Christian Lives Matter

United States Representative Riley Moors has said further military strikes against Islamic State-linked militants in Nigeria could follow recent operations ordered by President Donald Trump, describing the actions as aimed at improving security and protecting Christian communities facing violence.

Moore made the remarks during a televised interview in which he addressed U.S. military strikes carried out on Christmas Day against militant targets in North-west Nigeria.

The strikes were conducted in coordination with the Nigerian government, according to U.S. and Nigerian officials.

“President Trump is not trying to bring war to Nigeria, he’s bringing peace and security to Nigeria and to the thousands of Christians who face horrific violence and death,” Moore said.

He said the Christmas Day strikes against Islamic State affiliates had provided hope to Christians in Nigeria, particularly in areas affected by repeated attacks during past festive periods.

According to U.S. authorities, the strikes targeted camps used by Islamic State-linked groups operating in parts of north-west Nigeria.

Nigerian officials confirmed that the operation was carried out with intelligence support from Nigerian security agencies as part of ongoing counter-terrorism cooperation between both countries.

The United States Africa Command said the operation was intended to degrade the operational capacity of extremist groups responsible for attacks on civilians and security forces.

Nigerian authorities have described the targeted groups as a threat to national security, noting their involvement in killings, kidnappings and raids on rural communities.

Moore said the strikes marked a shift from previous years in which attacks were carried out against civilians during the Christmas period. He said the U.S. administration was focused on preventing further violence by targeting militant groups before they could launch attacks.

U.S. officials have said the military action was carried out with the consent of the Nigerian government and formed part of broader security cooperation between the two countries. Nigeria has received intelligence, training and logistical support from international partners as it seeks to contain militant activity.

Moore had previously called for stronger international attention to attacks on Christian communities in Nigeria and has urged continued U.S. engagement in addressing extremist violence. He said further action would depend on developments on the ground and continued coordination with Nigerian authorities.

Nigerian officials have maintained that counter-terrorism operations are directed at armed groups threatening civilians, regardless of religion, and have reiterated their commitment to restoring security across affected regions.