Business

Bloomberg Says Danjuma Made Staggering Wealth from Oil, Worth $1.2bn

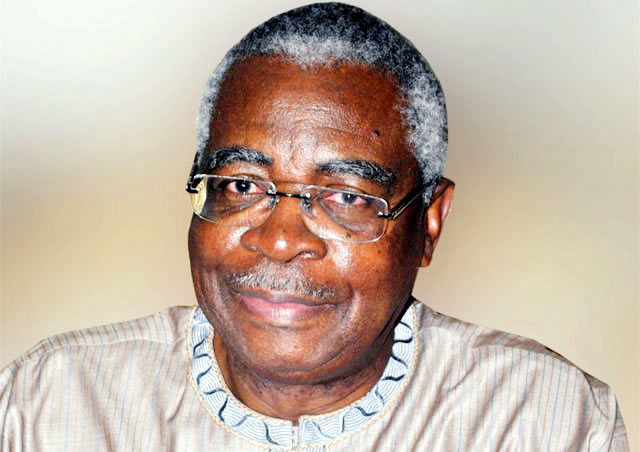

Lt-Gen Theophilus Danjuma (rtd) is currently worth $1.2 billion, according to the Bloomberg Billionaires Index. This amounts to over N400 billion based on the current exchange rate.

Danjuma retired from the Nigerian Army in 1979. He reportedly made his wealth from oil block awarded to him.

In a new report which details his staggering wealth, Bloomberg says the 80-year-old former military officer owns a 300-year-old inn in the city of London.

Popularly known as “The Kings Arms Hotel”, the 300-year-old inn, next to London’s Hampton Court Palace, was once the home of Henry VIII.

“It’s poised to open soon after refurbishment, with rooms costing about 250 pounds ($318) a night. Guests can dine on traditional fare in the Six restaurants, a reference to the monarch’s many wives, or grab a pint on the terrace.

“But for Theophilus Danjuma, this is just one investment in a network of assets that span at least three continents. The 80-year-old Nigerian is worth $1.2 billion, according to the Bloomberg Billionaires Index, with his family office managing a portion of that wealth, often through low-key holdings such as the 14-room hotel,” Bloomberg reports.

In addition to the Kings Arms Hotel, the Danjumas have also developed residential properties this year in Esher and Wimbledon.

The report further reads, “They (Danjumas) also own a boutique hotel in Lagos, serving beef carpaccio and lobster bisque in one of three dining areas and displaying works from the family’s art firm.

“Danjuma’s new venture is far removed from civil war and deepwater oil fields, the spheres where he amassed his power and fortune. In 2006, his South Atlantic Petroleum Ltd. sold almost half its contractor rights for a section off Nigeria’s coast to a state-backed Chinese firm for $1.8 billion.

“Danjuma was awarded the block in 1998 by the regime of former dictator and fellow army officer, Sani Abacha, making him one of a handful of Nigerians made extraordinarily wealthy from the country’s energy reserves.”

Danjuma was born in 1938, the year Royal Dutch Shell received its first oil exploration license for the country and more than two decades before it gained independence from Britain.

He dropped out of college in 1960 to join the army, according to “Nigerian Politics in the Age of Yar’Adua” by Bayode Ogunmupe. He gained prominence after participating in the 1966 counter-coup against Nigeria’s first military dictator.

A decade later, he was stepping out of a Rolls-Royce in central London to meet British military officials in his role as chief of staff of the Nigerian Army.

He left the military in 1979 and founded his oil firm and a shipping company, NAL-Comet, which now has more than 2,000 employees in Nigeria. Danjuma paid $25 million in 1998 for the oil field exploration license that made him a billionaire. A year later, he became Nigeria’s defence minister as the country returned to democracy.

He originally teamed up with Total SA and Brazil’s Petroleo Brasileiro SA on the block. The minority stake that Danjuma’s company now owns is worth $450 million, according to Bloomberg’s wealth index.

While Mayfair is the hub of London’s family offices, the Danjumas chose the city’s southwest suburbs to set up their investment firm a decade ago. They’ve since invested in property in that area, including the 2.5 million-pound purchase in 2010 of the building where their office is now based, according to filings.

Beyond the U.K., they own real estate in California and have bought and sold property in Singapore. Their family office also oversees private equity investments, trust funds and a venture capital arm that backs family-run art and film companies. The Danjumas own more than 30 properties worldwide, filings show.

“We invest in real estate in other jurisdictions, but in the U.K. we always thought let’s stick to areas that we know,” says daughter Hannatu Gentles, the second of Danjuma’s five children and chief operating officer of his London-based family office.

Her father bought a residence in Singapore years ago, “and it made sense then to buy some more,” she said, adding they’ve since sold the properties because of tax law changes.

It might seem contradictory given the extent of his wealth, but he is quite well respected and almost looked upon as an elder in political circles,” said Roy, co-research director of the SOAS-led Anti-Corruption Evidence initiative. “The military held him in such high regard that he was able to help manage Nigeria’s transition from military rule to democracy.”

Owning a hotel in Nigeria led the family to look for a similar deal in the U.K. Two years ago, they paid 2.4 million pounds for the Kings Arms. Redevelopment work was expected to end in March, filings show, but the inn’s age and protected status resulted in higher costs and delays.

“This is the first, and will possibly be the last, listed building we’ve worked on,” Gentles said. “It’s taken longer than we wanted, but our name is attached to the building and we want to be proud of our work. It’s been a hard slog.”

SarahaReporters

Business

FirstBank Launches 500-Seater Bleacher at Carnival Calabar & Festival 2025

West Africa’s premier financial institution and financial inclusion services provider, FirstBank, has officially announced its sponsorship of the Carnival Calabar & Festival 2025, unveiling a landmark addition set to redefine the carnival experience — the first-ever private premium seating area at the event.

The highlight of FirstBank’s participation is the construction of a 500-seater premium bleacher, designed to provide comfort, safety, and an elevated viewing experience for carnival enthusiasts.

Speaking on the sponsorship, the Acting Group Head Marketing and Corporate Communications, FirstBank, Olayinka Ijabiyi, noted that the carnival aligns with the Bank’s First@Arts initiative, a platform dedicated to supporting the creative arts value chain across Nigeria. He said, “We recognise the transformative power of the arts, including carnivals, in inspiring people and strengthening national unity. For more than 131 years, we have supported platforms that promote self-expression, social reflection and cultural exchange. Our investment in the Carnival Calabar & Festival demonstrates our commitment to preserving the nation’s rich cultural heritage through First@Arts.”

“As part of our sponsorship this year, we are introducing the first-ever private 500-seater premium bleacher to further elevate the carnival experience. This exclusive seating is designed to provide exceptional comfort and an unforgettable viewing experience for attendees,” Ijabiyi added.

The Chairman of the Cross River State Carnival Calabar Commission, Gabe Onah, also commented on FirstBank’s sponsorship. “FirstBank’s involvement is a strong demonstration of private-sector support for culture and tourism. This partnership not only enhances the overall quality of the carnival but also strengthens its global appeal,” he said.

The Carnival Calabar & Festival 2025 is officially marketed by Okhma Global Limited, the appointed Official Marketer responsible for brand partnerships, promotional engagements, and ticket sales. Okhma Global Limited has partnered with the Cross River State government in delivering Carnival Calabar & Festival for over ten years, playing a key role in strengthening the carnival’s commercial growth and global visibility.

Business

Yuletide: Ecobank Urges Vigilance, Guarantees Seamless Banking

Ecobank Nigeria, a member of Africa’s leading pan-African banking group, has assured customers of uninterrupted access to banking services throughout the year-end holiday period via its secure and robust digital platforms. The Bank also urged customers to remain vigilant against fraud and scams during the festive season.

Speaking on the development, Victor Yalokwu, Head, Products & Analytics, Consumer & Commercial Banking, Ecobank Nigeria, said the Bank’s digital channels — including the Ecobank Mobile App, Ecobank Business App, USSD *326#, Ecobank Online, OmniPlus, Omnilite, EcobankPay, RapidTransfer, Ecobank Cards, ATMs, PoS terminals, and over 35,000 Ecobank Xpress Point (Agent Banking) locations nationwide — will remain fully available to support customers throughout the yuletide and year-end holiday period.

He noted that customers will continue to enjoy a wide range of services during the period, including local and international funds transfers, bill payments and airtime top-ups, merchant payments, balance inquiries and account statements, as well as cardless cash withdrawals via ATMs.

According to Yalokwu, “Ecobank encourages customers to leverage these digital solutions for safe, fast, and efficient banking, especially during the festive season when convenience and reliability are essential. While physical branch operations may be subject to adjusted working hours in line with public holidays, customers can be assured that Ecobank’s digital platforms are designed to deliver uninterrupted service and enhanced security at all times. Ecobank remains committed to providing innovative financial solutions and exceptional customer service, and we wish all our customers a joyful festive season and a prosperous New Year.”

Yalokwu also cautioned customers to remain vigilant against fraudsters and scammers during the period. “Before you wrap up the year, tighten your security. December brings online sales, travel, and year-end distractions—this is exactly when scammers are most active. From fake festive deals to cloned merchant sites and suspicious messages, staying vigilant helps keep your money safe.”

He advised customers to shop only on trusted websites, never share their PINs, passwords, or one-time passwords (OTPs), avoid banking on public Wi-Fi networks, be cautious of urgent or emotionally charged messages, and regularly review their account activity.

Business

Fidelity Bank Donates Hoses, Water Pumps to Fire Service

Fidelity Bank Plc has donated firefighting and preventive equipment, including hoses and gasoline-powered water pumps, to the Ikoyi Fire Service Station in Lagos, reinforcing efforts to improve emergency response and promote community safety.

The donation was executed under the Fidelity Helping Hands Programme (FHHP) by the bank’s True Serve team. Through the initiative, Fidelity Bank employees identify critical community needs, raise funds, and receive matching financial support from the bank to implement impact-driven projects.

Speaking on the initiative, Divisional Head, Brand and Communications Division at Fidelity Bank, Dr Meksley Nwagboh, said the intervention reflects the bank’s commitment to public safety, environmental protection, and sustainable community development.

“Community safety is a shared responsibility. Fidelity Bank remains committed to supporting initiatives that protect lives, property, and the environment,” Nwagboh said, adding that preventive measures remain more effective than emergency responses.

He noted that providing the right tools to first responders aligns with the bank’s broader goal of enabling people to live safe, meaningful, and empowered lives.

Lagos State Controller of the Federal Fire Service, Controller of Fire (CF) Funke Adebayo, commended Fidelity Bank for the timely support, particularly as the festive season approaches amid dry weather conditions that heighten fire risks.

She urged residents to remain vigilant and warned parents against allowing children to handle fireworks during celebrations, stressing that careless handling of fire could lead to avoidable disasters.

Adebayo also disclosed that the Fire Service has intensified sensitisation visits to corporate organisations to promote fire safety and discourage unsafe practices.

Also speaking, Area Commander, Onikan Fire Station, Chief Superintendent of Fire (CSF) Oswere Michael, expressed appreciation for the donation, noting that it would strengthen the station’s operational capacity.

He encouraged households, businesses, and community members to prioritise fire safety, describing collective responsibility as critical to preventing fire outbreaks.

Fidelity Bank Plc is a full-fledged commercial deposit money bank serving over 9.1 million customers through its digital platforms, 255 business offices across Nigeria, and its UK subsidiary, FidBank UK Limited. The bank has received multiple local and international awards in recognition of its performance in digital transformation, MSME banking, and innovative financial services.

Photo – L-R: Lagos State Controller, Federal Fire Service, CF (Controller of Fire), Adebayo Funke; Tolulope Rojaiye, Marketing Business Partner, Fidelity Bank Plc; Assistant Superintendent of Fire, Ishola Folorunsho Olufemi; and Station Commander, Onikan Fire Station, Lagos, Okeke Ferdinand; during the donation of firefighting equipment to the Federal Fire Service at Ikoyi, Lagos, recently.