Headlines

EFCC Alleges N75m Was Recovered from Ex-Minister’s Wife

An operative with the Economic and Financial Crimes Commission, Bello Hamma-Adama, has told Justice Inyang Ekwo, of a Federal High Court in Abuja that a sum of N75m was recovered from Halima Turaki, wife of a former Minister for Special Duties and Inter-Governmental Affairs.

Tanimu Turaki was a former Minister for Special Duties and Inter-Governmental Affairs during the administration of Dr Goodluck Jonathan between 2013 and 2015.

He also served as the Minister for the Federal Ministry of Labour between 2014 and 2015.

Hamma-Adama, the fifth prosecution witness in the ongoing trial of Turaki, made the observations before Justice Ekwo on Wednesday.

The EFCC had arraigned Turaki alongside his former Special Assistant, Sampson Okpetu, and two firms, Samtee Essentials Ltd and Pasco Investment Ltd, on a 16-count charge of money laundering.

Although Turaki and Okpetu pleaded not guilty to the charges, the anti-graft agency alleged that the defendants used the companies to launder the fund totalling N845m taken from the two ministries where the ex-minister held sway under the Jonathan administration.

While being led in evidence by the counsel to the EFCC, Mohammed Abubakar, the witness said about N359m was moved from the Ministry of Special Duties for a sensitisation project for the government.

Hamma-Adama, who was the lead investigator in the agency, however, said the money was later transferred in tranches into private individuals’ accounts.

Giving the breakdown, he said N45m was allegedly transferred to the ex-Minister’s brother, Abdullahi Maigwandu, through his Zenith Bank account.

Out of the N45m, he said Maigwandu transferred N20m to the Guarantee Trust Bank account of Halima Tanimu Turaki, the ex-minister’s wife.

According to the fifth prosecution witness, the sum of N20m was transferred to O-Pec Nig Ltd.

He said the remaining N5m was withdrawn in China using the ATM of Maigwandu by Halima to procure furniture items.

“The sum of N30m was transferred to Abubakar Sani Gude’s Zenith Bank account from the ministry’s account and the N30m was sent to the wife of the first defendant (Turaki),” he said.

Hamma-Adama said when Maigwandu was invited for interrogation, he confessed that the money came from the ministry and he neither had any business with the ministry nor engaged in any sensitisation exercise.

The witness said Maigwandu, a civil servant in Kebbi with a monthly salary of N33,000, also told the EFCC that the N45m was received by the ex-Minister’s wife.

“We called for the Maigwandu’s account statement in Zenith Bank. We discovered that he is a civil servant in Kebbi on a salary of about N33, 000.

“We suspected a case of money laundering and we did a network analysis and we discovered that he could not have owned that money because he is on a N33, 000 salary”, Hamma-Adama said.

He said Maigwandu told the investigators that every money in that account belonged to Turaki, except his salary.

“He said he is a brother to the former minister and that the money was transferred on his instruction,” the EFCC operative added.

Hamma-Adama hinted that as at the time the N45m was transferred to Maigwandu, he was having about N7,300 in his account.

He said with all the information gathered, Halima was invited to their office.

“She came alongside the first defendant (her husband) and a lawyer. On video, she mentioned that the transaction was done at her instance.

“She said she was not a contractor with the Ministry of Special Duties and that she did not carry out any sensitisation exercise for the ministry. We ask if she knows Gode and Gwandu and she said she did. She said the transaction was her transaction and it was done on her instructions”, the witness said.

Justice Ekwo adjourned the matter till February 9 and 10 for the continuation of the trial.

The Punch

Headlines

US Lawmaker Seeks More Airstrikes in Nigeria, Insists Christian Lives Matter

United States Representative Riley Moors has said further military strikes against Islamic State-linked militants in Nigeria could follow recent operations ordered by President Donald Trump, describing the actions as aimed at improving security and protecting Christian communities facing violence.

Moore made the remarks during a televised interview in which he addressed U.S. military strikes carried out on Christmas Day against militant targets in North-west Nigeria.

The strikes were conducted in coordination with the Nigerian government, according to U.S. and Nigerian officials.

“President Trump is not trying to bring war to Nigeria, he’s bringing peace and security to Nigeria and to the thousands of Christians who face horrific violence and death,” Moore said.

He said the Christmas Day strikes against Islamic State affiliates had provided hope to Christians in Nigeria, particularly in areas affected by repeated attacks during past festive periods.

According to U.S. authorities, the strikes targeted camps used by Islamic State-linked groups operating in parts of north-west Nigeria.

Nigerian officials confirmed that the operation was carried out with intelligence support from Nigerian security agencies as part of ongoing counter-terrorism cooperation between both countries.

The United States Africa Command said the operation was intended to degrade the operational capacity of extremist groups responsible for attacks on civilians and security forces.

Nigerian authorities have described the targeted groups as a threat to national security, noting their involvement in killings, kidnappings and raids on rural communities.

Moore said the strikes marked a shift from previous years in which attacks were carried out against civilians during the Christmas period. He said the U.S. administration was focused on preventing further violence by targeting militant groups before they could launch attacks.

U.S. officials have said the military action was carried out with the consent of the Nigerian government and formed part of broader security cooperation between the two countries. Nigeria has received intelligence, training and logistical support from international partners as it seeks to contain militant activity.

Moore had previously called for stronger international attention to attacks on Christian communities in Nigeria and has urged continued U.S. engagement in addressing extremist violence. He said further action would depend on developments on the ground and continued coordination with Nigerian authorities.

Nigerian officials have maintained that counter-terrorism operations are directed at armed groups threatening civilians, regardless of religion, and have reiterated their commitment to restoring security across affected regions.

Headlines

Renowned Boxer Anthony Joshua Survives Ghastly Road Accident

World-renowned boxer Anthony Joshua on Monday survived a ghastly road accident in Makun, Ogun State.

Eyewitnesses report that the incident occurred along a busy highway of the Lagos-Ibadan expressway.

The vehicle carrying Joshua, a Lexus Jeep with the number plate, KRD 850 HN, reportedly collided with a stationary truck under circumstances that are still being investigated.

Joshua reportedly sustained minor injuries, while two persons were said to have died on the spot.

Headlines

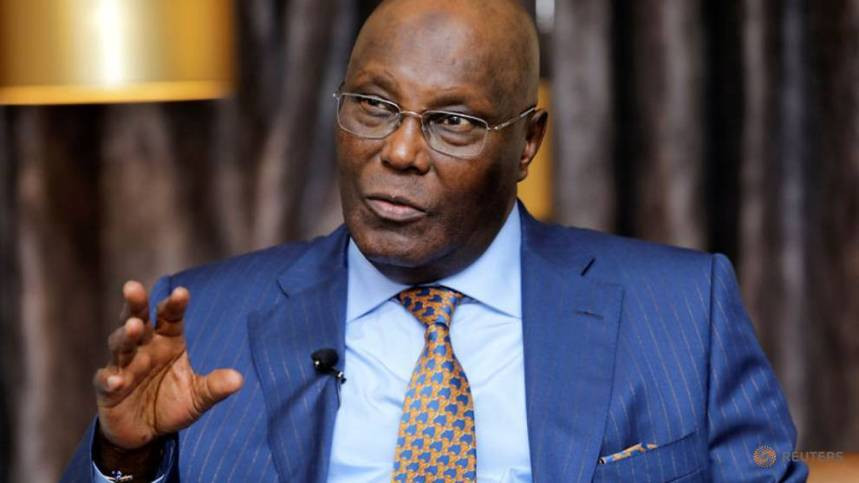

Atiku Warns Against Hasty Re‑gazetting of New Tax Laws

Former Vice President Atiku Abubakar has cautioned that any attempt to hurriedly re‑gazette Nigeria’s new tax laws could undermine parliamentary oversight and set a dangerous constitutional precedent.

Atiku’s warning follows public scrutiny over reports that the Tax Reform Acts signed by President Bola Tinubu differ from the versions passed by the National Assembly. Lawmakers, including Abdussamad Dasuki, raised concerns that the alterations could pose serious legal and constitutional risks, noting that they were not backed by any constitutional framework.

In a statement on X, Atiku said the directive to re-gazette the Acts effectively confirms “that the gazetted version of the Tinubu Tax Act does not reflect what was duly passed by the National Assembly,” calling it “a grave constitutional issue.”

He emphasized that under Section 58 of the 1999 Constitution, a bill only becomes law after passage by both chambers, presidential assent, and gazetting.

“Gazetting is merely an administrative act of publication. It does not create, amend, or validate a law,” Atiku said, adding that any post-passage insertion, deletion, or modification without legislative approval constitutes forgery rather than a clerical error.

Atiku further warned that rushing a re-gazetting while legislative investigations are ongoing “undermines parliamentary oversight and sets a dangerous precedent,” stressing that the only lawful approach is “fresh legislative consideration, re-passage by both chambers, fresh presidential assent, and proper gazetting.”

The former vice president clarified that his position is not opposition to tax reform but a defence of constitutional order.

“This is a defence of the integrity of the legislative process and a rejection of any attempt to normalise constitutional breaches through procedural shortcuts,” he said.

The Federal government has denied wrongdoing, insisting the laws will take effect as scheduled on January 1, 2026, while the National Assembly has directed the issuance of Certified True Copies of the Acts to ensure clarity and accuracy.