Headlines

FirstBank Wins Best Mobile Banking App, Fastest Growing Retail Bank Awards

FirstBank of Nigeria Limited has been named 2019 “Best Mobile Banking App” and “Fastest Growing Retail Bank” winner by Global Business Outlook. The Global Business Outlook Award recognises and rewards excellence in business in companies across the world, both in the public and private sectors. The award rewards innovation, creativity and the drive to create value.

FirstBank earned the Fastest Growing Retail Bank recognition because of its leading role in promoting financial inclusion in the country, a drive which has resulted in its 44,000 Agent Banking network designed to complement the provision of bespoke financial services at its over 750 branches nationwide.

It also won the Best Mobile Banking App award thanks to its Firstmobile banking app’s capability at performing a wide range of financial transactions in a safe, adaptable, futuristic and efficient manner. The user friendly app is widely renowned for its ease of navigation and state of the art security features to mitigate risk against fraud.

In the course of 2019, FirstBank bagged numerous awards across various areas of its business operations. The awards comprise Women Empowerment Category – Sustainable Banking Awards by CBN Bankers Committee, Best Private Bank in Nigeria 2019 by Global Finance Magazine and World Finance Magazine respectively; Best Process Automation Initiative, Application or Programme by Asian Banker International Excellence in Retail Financial Services; Best Banking Brand Nigeria 2019 by Global Brands Magazine; Best Retail Bank in Nigeria by Global Banking and Finance Review and Asian Banker International Excellence in Retail Financial Services Awards respectively; Cashless Driver: Highest Volume in Bill Payments and Highest Transaction Volume in Real-Time Payments by CBN Electronic Payments Incentive Scheme (EPIS) – Efficiency Awards; Long Service Corporate Award by Nigerian Economic Summit Group; Best Financial Inclusion Program – Nigeria 2019 and Bank of The Year – Nigeria 2019 by International Investor, amongst many others.

Speaking on the awards, Folake Ani-Mumuney, the Bank’s Group Head, Marketing & Corporate Communications said, ”We appreciate these awards and the recognition by the respective awarding bodies. The awards are dedicated to all our customers across the globe as their continued patronage of our services is appreciated. We remain steadfast and would not rest on our laurels at rendering bespoke financial services tailored to meet the financial needs of our valued customers, irrespective of where they may be.”

Headlines

Renowned Boxer Anthony Joshua Survives Ghastly Road Accident

World-renowned boxer Anthony Joshua on Monday survived a ghastly road accident in Makun, Ogun State.

Eyewitnesses report that the incident occurred along a busy highway of the Lagos-Ibadan expressway.

The vehicle carrying Joshua, a Lexus Jeep with the number plate, KRD 850 HN, reportedly collided with a stationary truck under circumstances that are still being investigated.

Joshua reportedly sustained minor injuries, while two persons were said to have died on the spot.

Headlines

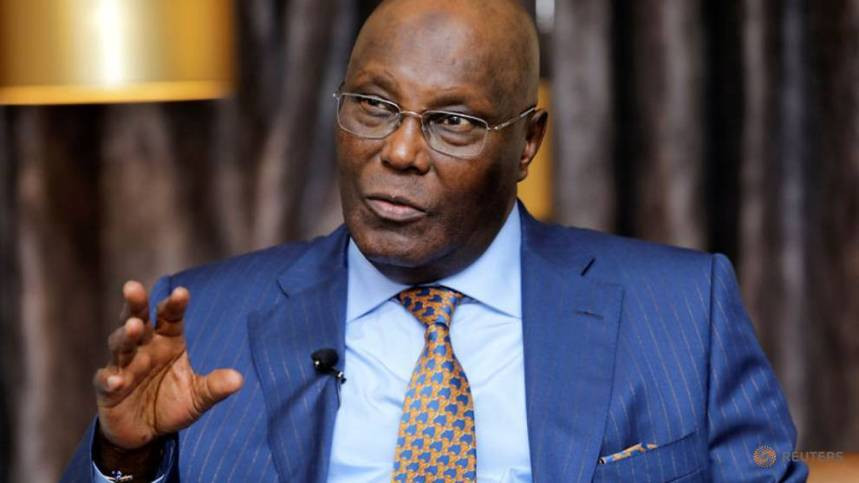

Atiku Warns Against Hasty Re‑gazetting of New Tax Laws

Former Vice President Atiku Abubakar has cautioned that any attempt to hurriedly re‑gazette Nigeria’s new tax laws could undermine parliamentary oversight and set a dangerous constitutional precedent.

Atiku’s warning follows public scrutiny over reports that the Tax Reform Acts signed by President Bola Tinubu differ from the versions passed by the National Assembly. Lawmakers, including Abdussamad Dasuki, raised concerns that the alterations could pose serious legal and constitutional risks, noting that they were not backed by any constitutional framework.

In a statement on X, Atiku said the directive to re-gazette the Acts effectively confirms “that the gazetted version of the Tinubu Tax Act does not reflect what was duly passed by the National Assembly,” calling it “a grave constitutional issue.”

He emphasized that under Section 58 of the 1999 Constitution, a bill only becomes law after passage by both chambers, presidential assent, and gazetting.

“Gazetting is merely an administrative act of publication. It does not create, amend, or validate a law,” Atiku said, adding that any post-passage insertion, deletion, or modification without legislative approval constitutes forgery rather than a clerical error.

Atiku further warned that rushing a re-gazetting while legislative investigations are ongoing “undermines parliamentary oversight and sets a dangerous precedent,” stressing that the only lawful approach is “fresh legislative consideration, re-passage by both chambers, fresh presidential assent, and proper gazetting.”

The former vice president clarified that his position is not opposition to tax reform but a defence of constitutional order.

“This is a defence of the integrity of the legislative process and a rejection of any attempt to normalise constitutional breaches through procedural shortcuts,” he said.

The Federal government has denied wrongdoing, insisting the laws will take effect as scheduled on January 1, 2026, while the National Assembly has directed the issuance of Certified True Copies of the Acts to ensure clarity and accuracy.

Headlines

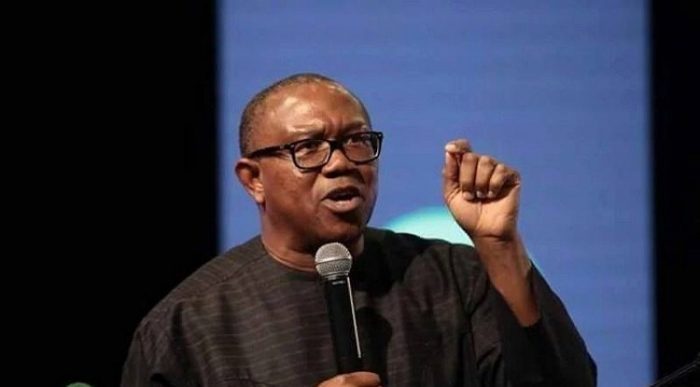

2027: Aide Confirms Peter Obi’s Imminent Defection to ADC

Barring unforeseen circumstances, the Labour Party (LP) Presidential Candidate in the 2023 elections, Mr. Peter Obi, is set to formally join the African Democratic Congress (ADC) on December 31, 2025.

The development would put to rest months of speculation about where the former Governor of Anambra State would pitch his tent in the coming elections.

Reports claim that Obi would be defecting with serving senators and other lawmakers elected on the platform of the LP, as well as remnants of the Peoples’ Democratic Party (PDP) in the South East region.

Specifically, Obi would be defecting alongside the Senator representing Anambra Central, Victor Umeh; that of Anambra North, Tony Nwoye; Abia South, Enyinnaya Abaribe; PDP chieftain Ben Obi; and members of the Obidient movement in the region.

It is not clear if the Abia State governor, Alex Otti, is part of the planned movement to the ADC.

The governor was recently approached by the PDP to join the party and re-contest his current position in 2027.

Further reports quoted Obi’s spokesperson, Valentine Obienyem, as confirming the planned defection of his boss to the ADC.

“Yes, it is true,” he reportedly said on Sunday.

Senator Umeh said the event would hold in Enugu, adding that it would involve all Obi’s supporters across the South East region.

“They will come from Abia, Anambra, Ebonyi and Imo states to join those in Enugu, where this exercise will hold on 31st December,” he reportedly added.

Sources hinted that Obi, who has not hidden his intention to appear on the ballot in 2027, would contest the presidential ticket of the ADC.

On his part, Chief Chekwas Okorie, reportedly said that the expected formal defection of Obi to the ADC is a healthy development that could reshape the thinking and permutations of the 2027 general elections.

“I imagine that he would be defecting along with most of his associates and followers. I believe that a fortified and strong ADC will add value to the opposition and assuage the general fear of a possible one-party option to Nigerians come 2027. The APC, ADC and possibly the PDP locking horns in the 2027 democratic encounter promises a vibrant and robust electioneering campaign that will provide Nigerians the required options to make informed choices in electing their preferred leaders at all levels. I imagine that the APC leadership will return to the drawing table to map out the strategy to confront the emerging challenge. Nigerians are in interesting times,” Okorie stated.

National President of Njiko Igbo Forum (NIF), Rev Okechukwu Obioha, vouched support for Obi to ensure he reaches the pinnacle of his political career. He, however, cautioned that the ADC should not compromise merit and integrity in the choice of its presidential candidate, stressing that Obi remains the “hope for the restoration of the country on the path of greatness.”