Headlines

I’m Not Due for Retirement Yet, NASS Clerk, Sani-Omolori Kicks

The clerk of the National Assembly, Mohammed Sani-Omolori, has reacted the compulsory retirement notice issued to him by the National Assembly Service Commission. In a statement on Wednesday evening, the clerk insisted that the retirement age for the National Assembly remains 40 years of service or 65 years of age.

He said the resolution of the National Assembly which increased the age and years of service has not been amended.

He also said the commission has no powers to intervene in the controversy.

“The attention of the National Assembly Management has been drawn to a press release dated 15th July, 2020 signed by the Chairman of the National Assembly Service Commission, informing the general public that the commission has approved the retirement age of staff of the National Assembly as 35 years of service or 60 years of age whichever comes first.

“The Management of the National Assembly wishes to inform all staff and the general public that the extant regulation as contained in our Revised Conditions of Service duly passed by both Chambers of the 8th National Assembly puts the retirement age of staff at 40 years of service and 65 years of age whichever comes first.

“The Resolution of the 8th National Assembly on the Conditions of Service of Staff has not been rescinded nor abdicated by the National Assembly, who under the authentic National Assembly Service Act 2014 as passed is empowered to review any proposed amendment to the Conditions of Service by the Commission.”

“Therefore, the National Assembly Service Commission does NOT have the powers to set aside the Revised Conditions of Service as passed by the 8th National Assembly.”

He said the management “had maintained a studied silence in deference to the leadership of the 9th National Assembly which is looking into the position being canvassed by the commission but finds it intriguing that the National Assembly Service Commission has unilaterally gone ahead to take a decision.”

He urged all staff to disregard the press release by the commission and go about their lawful duties.

The controversial bill was proposed and passed at a time that the commission (known as NASC), which is the policy-making organ of the federal legislature, had not been constituted.

Following its constitution in February by President Muhammadu Buhari with Mr Amshi as its chairman, the NASC reviewed and decided to set aside the revised condition of service, saying it was self-serving and not duly passed.

This development has divided National Assembly workers in the Parliamentary Staff Association of Nigeria (PASAN).

While a faction is applauding the decision of the NASC to jettison the new rule, another is standing with the National Assembly management led by Mr Sani-Omolori.

An argument preferred by a group is that if the bill was passed by the National Assembly like similar ones, it thus requires assent by President Muhammadu Buhari to become law.

The other group counters, saying it does not require presidential assent but that NASC, which they pointed out was not on ground at the time the bill was passed, can move for a revision of its provisions.

The opponents of the bill also alleged that the five-year increase in service years “was smuggled through the back door” into the original body of proposals.

They fingered Mr Sani-Omolori, his management team and the leadership of the 8th National Assembly as the architects of the ‘surreptitious’ extension of service years under the guise of reviewing the conditions of service of legislative workers.

The revised conditions, however, appear to be very popular with a majority of the over 4,000-strong workforce of the National Assembly who all stand to benefit from the implementation, one way or the other.

Premium Times

Headlines

US Lawmaker Seeks More Airstrikes in Nigeria, Insists Christian Lives Matter

United States Representative Riley Moors has said further military strikes against Islamic State-linked militants in Nigeria could follow recent operations ordered by President Donald Trump, describing the actions as aimed at improving security and protecting Christian communities facing violence.

Moore made the remarks during a televised interview in which he addressed U.S. military strikes carried out on Christmas Day against militant targets in North-west Nigeria.

The strikes were conducted in coordination with the Nigerian government, according to U.S. and Nigerian officials.

“President Trump is not trying to bring war to Nigeria, he’s bringing peace and security to Nigeria and to the thousands of Christians who face horrific violence and death,” Moore said.

He said the Christmas Day strikes against Islamic State affiliates had provided hope to Christians in Nigeria, particularly in areas affected by repeated attacks during past festive periods.

According to U.S. authorities, the strikes targeted camps used by Islamic State-linked groups operating in parts of north-west Nigeria.

Nigerian officials confirmed that the operation was carried out with intelligence support from Nigerian security agencies as part of ongoing counter-terrorism cooperation between both countries.

The United States Africa Command said the operation was intended to degrade the operational capacity of extremist groups responsible for attacks on civilians and security forces.

Nigerian authorities have described the targeted groups as a threat to national security, noting their involvement in killings, kidnappings and raids on rural communities.

Moore said the strikes marked a shift from previous years in which attacks were carried out against civilians during the Christmas period. He said the U.S. administration was focused on preventing further violence by targeting militant groups before they could launch attacks.

U.S. officials have said the military action was carried out with the consent of the Nigerian government and formed part of broader security cooperation between the two countries. Nigeria has received intelligence, training and logistical support from international partners as it seeks to contain militant activity.

Moore had previously called for stronger international attention to attacks on Christian communities in Nigeria and has urged continued U.S. engagement in addressing extremist violence. He said further action would depend on developments on the ground and continued coordination with Nigerian authorities.

Nigerian officials have maintained that counter-terrorism operations are directed at armed groups threatening civilians, regardless of religion, and have reiterated their commitment to restoring security across affected regions.

Headlines

Renowned Boxer Anthony Joshua Survives Ghastly Road Accident

World-renowned boxer Anthony Joshua on Monday survived a ghastly road accident in Makun, Ogun State.

Eyewitnesses report that the incident occurred along a busy highway of the Lagos-Ibadan expressway.

The vehicle carrying Joshua, a Lexus Jeep with the number plate, KRD 850 HN, reportedly collided with a stationary truck under circumstances that are still being investigated.

Joshua reportedly sustained minor injuries, while two persons were said to have died on the spot.

Headlines

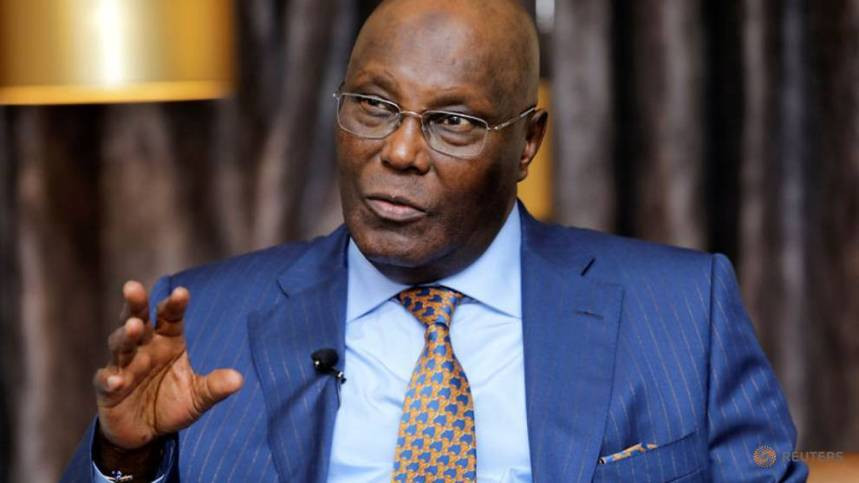

Atiku Warns Against Hasty Re‑gazetting of New Tax Laws

Former Vice President Atiku Abubakar has cautioned that any attempt to hurriedly re‑gazette Nigeria’s new tax laws could undermine parliamentary oversight and set a dangerous constitutional precedent.

Atiku’s warning follows public scrutiny over reports that the Tax Reform Acts signed by President Bola Tinubu differ from the versions passed by the National Assembly. Lawmakers, including Abdussamad Dasuki, raised concerns that the alterations could pose serious legal and constitutional risks, noting that they were not backed by any constitutional framework.

In a statement on X, Atiku said the directive to re-gazette the Acts effectively confirms “that the gazetted version of the Tinubu Tax Act does not reflect what was duly passed by the National Assembly,” calling it “a grave constitutional issue.”

He emphasized that under Section 58 of the 1999 Constitution, a bill only becomes law after passage by both chambers, presidential assent, and gazetting.

“Gazetting is merely an administrative act of publication. It does not create, amend, or validate a law,” Atiku said, adding that any post-passage insertion, deletion, or modification without legislative approval constitutes forgery rather than a clerical error.

Atiku further warned that rushing a re-gazetting while legislative investigations are ongoing “undermines parliamentary oversight and sets a dangerous precedent,” stressing that the only lawful approach is “fresh legislative consideration, re-passage by both chambers, fresh presidential assent, and proper gazetting.”

The former vice president clarified that his position is not opposition to tax reform but a defence of constitutional order.

“This is a defence of the integrity of the legislative process and a rejection of any attempt to normalise constitutional breaches through procedural shortcuts,” he said.

The Federal government has denied wrongdoing, insisting the laws will take effect as scheduled on January 1, 2026, while the National Assembly has directed the issuance of Certified True Copies of the Acts to ensure clarity and accuracy.