News

Lagos Dep Gov’s Brother Dies of COVID-19

The Nigeria Medical Association, Lagos State chapter, has announced the death of Dr. Haroun Hamzat, half brother of the Lagos State Deputy Governor, Dr Kadri Obafemi Hamzat.

According to the statement, the young medical doctor who worked in one of the public health centres in Orile Agege Local Council Development Area, was aged 37.

Reports say revealed that the budding medical practitioner may have died of complications from COVID-19 infection.

The statement described Dr. Hanzat’s death as a dark moment in the Nigerian Medical Association, Lagos State.

The Association commiserated with ‘his immediate family, friends, associates, colleagues and staff of Lagos State PHC Board and indeed the medical fraternity of Lagos State’.

The Gazelle reports that Hamzat was sick and later tested positive for COVID-19. It further stated that he was rushed to the Infectious Disease Hospital in Yaba where he later died.

News

Davido Commends Uncle, Gov Adeleke on Resignation from PDP

Nigerian Afrobeat music singer, David Adeleke aka Davido, has commented on his uncle, Governor Ademola Adeleke, after he resigned from the Peoples’ Democratic Party (PDP), posting “Jeje…” on his X page.

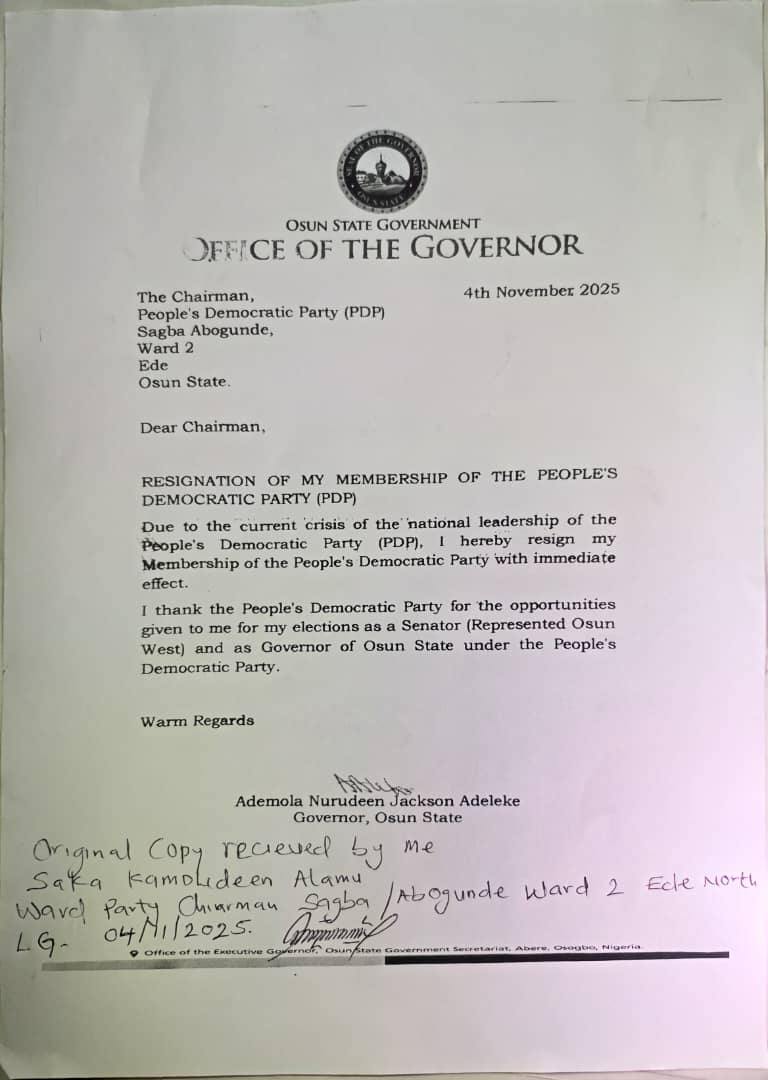

Adeleke, who represented Osun West as Senator and currently serves as the governor of the State, announced his resignation in a letter dated November 4, 2025, citing the party’s national leadership crisis.

The letter titled ‘Resignation of my membership of the Peoples’ Democratic Party (PDP)’ read: “Due to the current crisis of the national leadership of the Peoples’ Democratic Party (PDP), I hereby resign my Membership of the Peoples’ Democratic Party with immediate effect.”

He expressed gratitude for the opportunities afforded to him by the PDP.

“I thank the Peoples’ Democratic Party for the opportunities given to me for my elections as a Senator (Represented Osun West) and as Governor of Osun State under the Peoples’ Democratic Party,” he added.

The resignation has sparked reactions, with Davido’s post sparking speculation about the implications for the party.

News

Osun Gov Adeleke Dumps PDP, Silent on Next Party to Join

By Eric Elezuo

The governor of Osun State, Senator Ademola Adeleke, has announced his resignation from the Peoples Democratic Party (PDP).

A letter signed by the governor himself and dated November 4, 2025 revealed that the governor dumped the party about a month before coming out public with the announcement.

Confirming the resignation via a statement, the governor’s Chief Press Secretary, Mallam Olawale Rasheed, wrote;

“Governor Ademola Adeleke of Osun State has resigned his membership of the People’s Democratic Party (PDP) since November 4th, 2025.

“The letter was addressed to the PDP Chairman for ward 2, Sagba Abogunde of

Ede North Local government, Osun State.

“The letter reads as follows: ‘Due to the current crisis within the national leadership of the Peoples Democratic Party (PDP), I hereby resign my membership of the PDP with immediate effect.

‘I thank the Peoples Democratic Party for the opportunities given to me for my elections as a Senator (Represented Osun West) and as Governor of Osun State under the Peoples Democratic Party”, the governor noted in the letter personally signed by him.’

Neither the letter nor the spokesperson’s statement suggested the governor’s next port of call even as political parties in the state are in the season of primaries to elect flag bearers for the 2026 governorship election in the state.

News

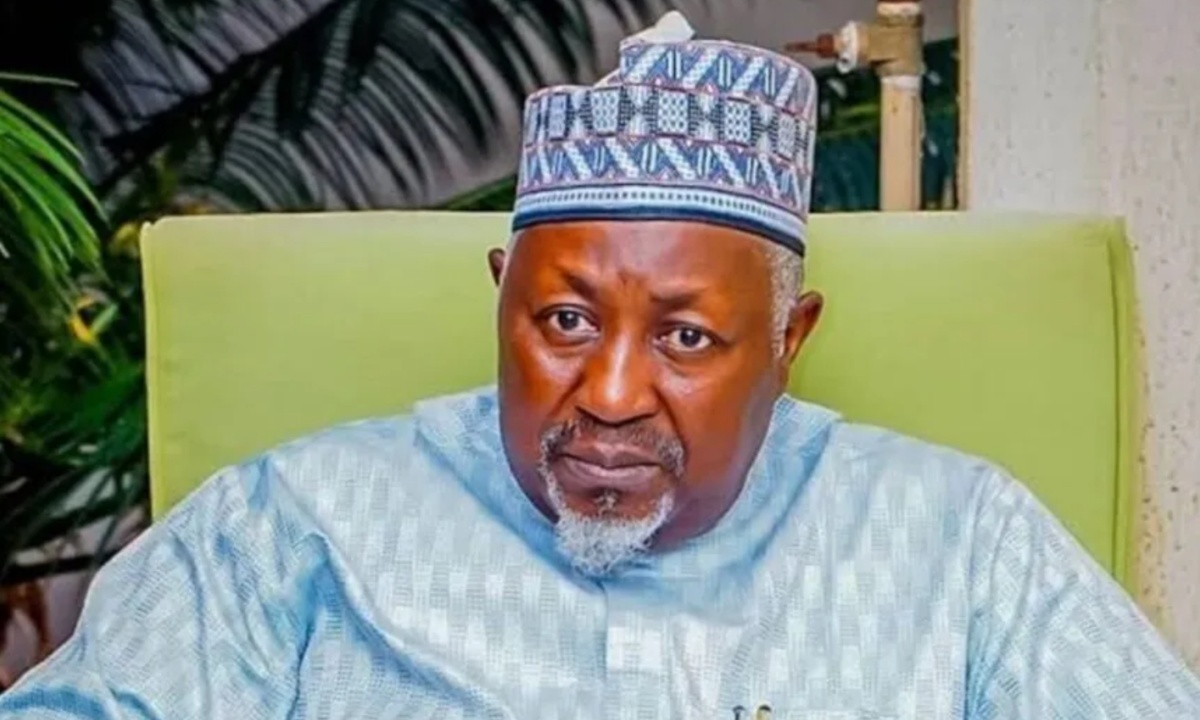

Just In: Defence Minister Abubakar Badaru, Resigns, Tinubu Accepts

By Eric Elezuo

The Minister of Defence, Alhaji Abubakar Mohammed Badaru, and a two-term former governor of Jigawa State, has resigned his appointment. This is shortly after the former Chief of Defence Staff, General Chris Musa (retd) visited Aso Rock Villa, and had a closed door meeting with President Bola Tinubu.

The resignation, which is with immediate effect, according to statement credited to the Special Adviser to the President on Information and Strategy, Bayo Onanuga, is contained in a letter dated December 1, 2025, and addressed to President Bola Tinubu. Badaru, who is 63 years, quoted health grounds as reason for quitting his job.

The statement added that “President Tinubu has accepted the resignation and thanked Abubakar for his services to the nation.

“President Tinubu will likely inform the Senate of Badaru’s successor later this week.

His resignation comes amid President Tinubu’s declaration of a national security emergency, with plans to elaborate on its scope in due course.

He served as defence minister for 27 months since August 21, 2023.