Business

Tech Firm Unveils Mobile App to Secure Devices

African tech-media firm Bit Bender Production Limited has released a mobile application, Verivault App, to the Nigerian market. This app allows device owners to register their devices online and receive a Digital Ownership Certificate. The app’s primary purpose is to safeguard innocent citizens from buying stolen devices and assist in the recovery of stolen ones by the original owners.

This is coming against the backdrop of the upsurge in the theft of mobile devices such as phones, laptops, and musical and DJ equipment across the country. At the same time, some innocent and unaware individuals have been jailed or fined for purchasing those devices.

Tosin Awodogan, the mastermind behind the idea, in a chat with TS Magazine, said promoting the Verivault App is necessary to create awareness and enable the citizenry to buy into the technology to safeguard their devices while also setting the platform as the first point of check to validate the status of any electronic device before purchasing it.

“Verivault app is a mobile app that allows users to register their electronic device with a serial number, IMEI, or vehicle with a VIN, otherwise known as chassis number. Your electronic devices are onboarded on your profile, and you own a Digital Ownership Certificate.”

According to him, the app, which can be downloaded from Apple’s App store or Android Google play store, has remarkable features beyond just registering a device to your profile. For example, users can search for and verify device ownership before buying, or transferring device ownership from one user to another in case of a sale.

If a stolen device is listed for sale by another user, a potential buyer can search the database, and it will display whom the device belongs to, provided it has been onboarded. It will even connect the actual owner with the searcher. This is applicable to devices registered on our platform, which is why the awareness is to see this as a FREE insurance policy for every device owner. Registration is free, adding your devices to your account is free, the searching device status is free, and your registered data remains on our platform even if the device is reset, the unique ID of the device still connects it to the owner and any search at any time will lead such missing device back to the owner.”

The techie concept seeks to engender a culture of “Search Before Buying” any item, similar to what is available in advanced countries where checks on a vehicle, for instance, by a potential buyer on its chassis, would reveal the vehicle’s history.

Tosin added that the firm was seeking the partnership and endorsement of the police authority on the app to protect users and help resolve any dispute raised between an owner and potential buyer in the event there is a match while searching device status, especially if the device is already marked stolen.

In his words, “If a user is accused wrongly, the suspect can provide evidence through the app that he bought a device legally, and even produce who from, thanks to the uploaded purchase receipt and transfer history features. This would reduce theft of phones, laptops, other electronic devices; and wrongful arrest of innocent citizens or buyers will, in turn, be a thing of the past.” More detail on the app website www.verivault.net

Business

FirstBank Integrates PAPSS into LIT App for Seamless Cross-Border Payments in Africa

Premier bank in West Africa and a leading financial inclusion service provider, FirstBank, has announced the successful integration of the Pan-African Payment and Settlement System (PAPSS) into its flagship digital banking platform, the LIT app, enabling customers to make instant, secure, and local currency-based cross-border payments across Africa.

PAPSS, developed by the African Export-Import Bank (Afreximbank) in collaboration with the African Union and the AfCFTA Secretariat, enables instant, low-cost payments in local currencies between African countries.

Speaking on the integration, the Group Executive, e-Business and Retail Products at FirstBank, Chuma Ezirim, said, “The integration of PAPSS into the LIT app is a testament to FirstBank’s commitment to delivering innovative, customer-centric solutions that simplify and enhance financial transactions. This milestone aligns with the Bank’s strategic goal of deepening digital capabilities and expanding access to seamless cross-border payment services across Africa.”

Commenting on this collaboration, Mike Ogbalu, CEO of PAPSS said, “Every time an individual, an SME or a Company sends money instantly within Africa in their own currency, we are not just moving funds, we are connecting ambitions, supporting livelihoods, and bridging dreams across borders. This collaboration with FirstBank and their LIT app brings us a step closer to making African borders invisible to movement of money, so that the continent’s entrepreneurs and families can focus on what matters most: building their future, not battling payment barriers.”

The LIT App, FirstBank’s innovative digital banking platform, offers a wide range of features including virtual cards, scheduled payments, and multiple transfers in one go, designed to meet the dynamic needs of customers. The addition of PAPSS expands its capabilities to support cross-border commerce, especially for individuals and SMEs engaged in pan-African business.

With PAPSS now live on the LIT App, FirstBank is breaking down barriers to payments, trade and financial inclusion across Africa. Customers can now send funds conveniently to other countries in Naira, without needing US dollar, GBP or Euro conversions. This landmark integration enables real-time cross-border payments in local African currencies, reduces transaction costs, and improves settlement efficiency. It also expands access to digital banking services, promotes financial inclusion, supports SMEs and fosters growth under the African Continental Free Trade Area (AfCFTA).

This integration of PAPSS to the LIT app reinforces FirstBank’s leadership in digital banking innovation and supports the African Continental Free Trade Area (AfCFTA) agenda by simplifying intra-African transactions.

Business

Lemon Friday Plus: Adron Home Fetes Customers with Mouthwatering Goodies, Discounts

Nigeria’s leading real estate company renowned for making homeownership affordable for all, Adron Homes and Properties, has unveiled the much-anticipated Lemon Friday Plus Promo; an upgraded version of its annual Lemon Friday campaign.

The Lemon Friday Plus Promo is designed to make property ownership easier, more flexible, and more rewarding for Nigerians both at home and in the Diaspora. With discount of up to 50% on all landed properties, flexible payment structures, and exciting gift packages, Adron Homes continues to fulfill its mission of providing affordable housing solutions nationwide.

According to the company’s Group Managing Director, Mrs Adenike Ajobo, the Lemon Friday Plus Promo was introduced as part of Adron Homes’ commitment to empower more Nigerians to become landowners despite the current economic challenges.

“For over a decade, we have continued to make property ownership possible for everyday Nigerians. Lemon Friday Plus takes that vision even further by making payments more flexible and the process of owning land more convenient and rewarding,” he said.

For the first time, subscribers can spread their initial deposits into five convenient installments, from July to November 30, 2025. This unique feature allows individuals and families to plan their finances while securing a plot in any Adron Homes estate of their choice.

The promo offers affordable entry options with tiered deposit packages:

* ₦300,000 (Bronze)

* ₦500,000 (Silver) – includes a cockerel & rice

* ₦1,000,000 (Gold)

* ₦3,500,000 (Diamond)

Each deposit category comes with exciting gift rewards, ranging from home appliances such as refrigerators, washing machines, and home theatres, to even cows for festive celebrations.

During the promo period, customers can enjoy a massive 50% discount on all Adron Homes estates nationwide and spread their remaining balance conveniently over 12 months.

This offer applies to all Adron Homes estates, including popular developments such as Treasure Park and Gardens (Shimawa), City of David Estate (Abeokuta), Grandview Park and Gardens (Atan-Ota), Manhattan Park and Gardens (Karshi, Abuja), among others.

With over 60 estates across Nigeria, Adron Homes provides customers the opportunity to own land in Lagos, Ogun, Abuja, Oyo, Osun, Niger, Nasarawa, Ekiti, and Plateau States.

Speaking further, the Managing Director, Mrs. Adenike Ajobo, who officially declared the Lemon Friday Plus sales open at the company’s Ibadan regional office, emphasized that the campaign underscores Adron Homes’ goal of building cities and creating affordable housing opportunities.

“This promo is not just about discounts; it’s about making real estate accessible to everyone; traders, salary earners, entrepreneurs, and even students. At Adron Homes, we believe everyone deserves a place to call home,” she noted.

The Lemon Friday Plus Promo is currently open to new and existing customers nationwide. Interested buyers can visit any Adron Homes regional office, call the company’s hotlines, or connect via its official website and social media handles to take advantage of this limited-time offer.

Business

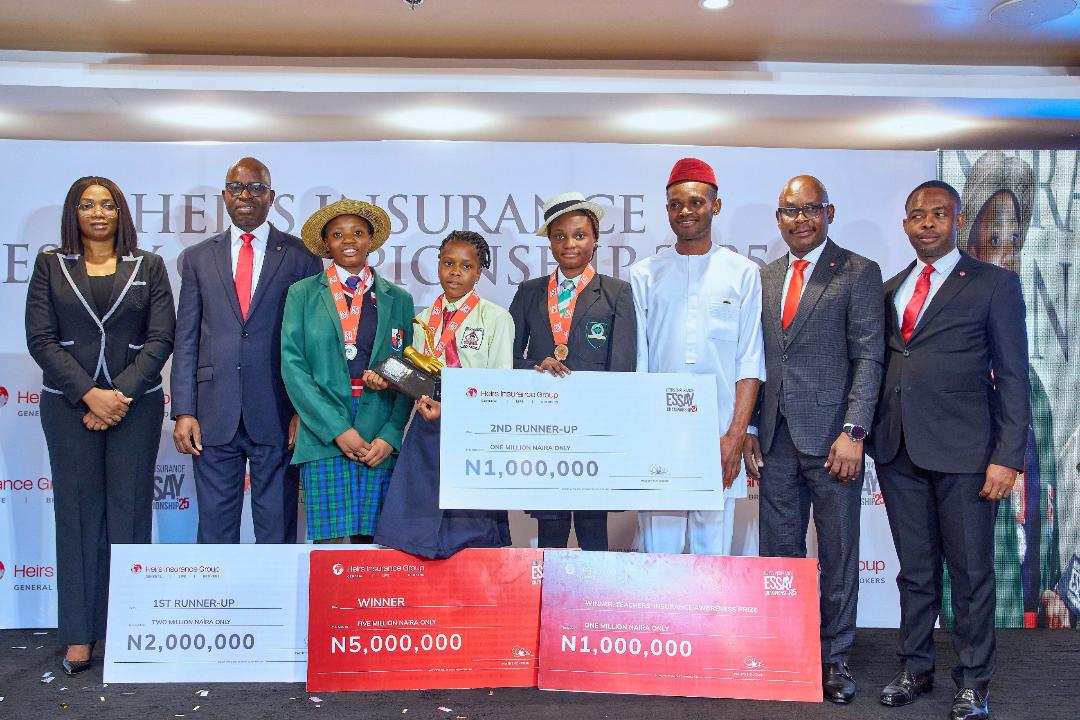

Rhema-Love Abraham, 13, Wins 2025 Heirs Insurance Essay Championship

Heirs Insurance Group, Nigeria’s fastest-growing insurance group, has announced the winners of the 4th edition of the Heirs Insurance Essay Championship, a nationwide competition promoting financial literacy and academic excellence among secondary school students and educators.

The grand finale, held at the Transcorp Hilton Hotel, Abuja, brought together students, parents, and academic leaders for a celebration of knowledge and creativity. This year’s edition, which attracted over 5,000 entries from junior secondary school students nationwide, was anchored on the topic “The Role of Insurance in Keeping Families Safe and Secure”.

After a rigorous evaluation process by a distinguished panel of academic professionals, independently verified by Deloitte & Touche, 13-year-old Rhema-Love Abraham of Precepts Learning Field, Lagos, emerged as the overall winner, earning a ₦5 million scholarship and a ₦1 million grant for her school.

Bernice Michael of S-TEE High School, Lagos, claimed the second-place position, winning a ₦2 million scholarship, while Afopefoluwa Tofio-Jacobs of D-IVY College, Ogun State, took third place, receiving a ₦1 million scholarship.

This year, Heirs Insurance introduced the inaugural Teachers Prize, to honor teachers promoting insurance awareness within their schools and communities. This initiative was created to democratise access to insurance literacy, working collaboratively with teachers and educators.

Mr. Okpe James Chidi, a teacher at Urban Secondary School, Umuna Orlu, Imo State, emerged as the winner of the Teachers’ Insurance Awareness Prize, with a personal award of ₦1 million cash prize, and a ₦500,000 grant for his school. His project, which deepened students’ understanding of financial literacy and insurance, was praised for its innovation, reach, and measurable impact.

Speaking at the ceremony, Niyi Onifade, Sector Head, Heirs Insurance Group, commended all the participants for their creativity and drive, emphasising the Group’s commitment to nurturing future leaders through education.

He said, “We are proud of every student and teacher who participated in this year’s Essay Championship. Their creativity, curiosity, and dedication reflect the future we envision for our nation; one built on knowledge, innovation, and resilience. At Heirs Insurance Group, we believe financial literacy is a powerful tool for empowerment and transformation”.

The Heirs Insurance Essay Championship is a flagship Corporate Social Responsibility (CSR) initiative of Heirs Insurance Group, created to build awareness of insurance literacy and critical thinking among young Nigerians. The introduction of the Teachers’ Insurance Awareness Prize further demonstrates the Group’s commitment to advancing insurance education and promoting financial inclusion at every level of society.