Personality in Focus

We Are Positioning for Digital Leadership, Market Dominance – Polaris CEO, Sonola

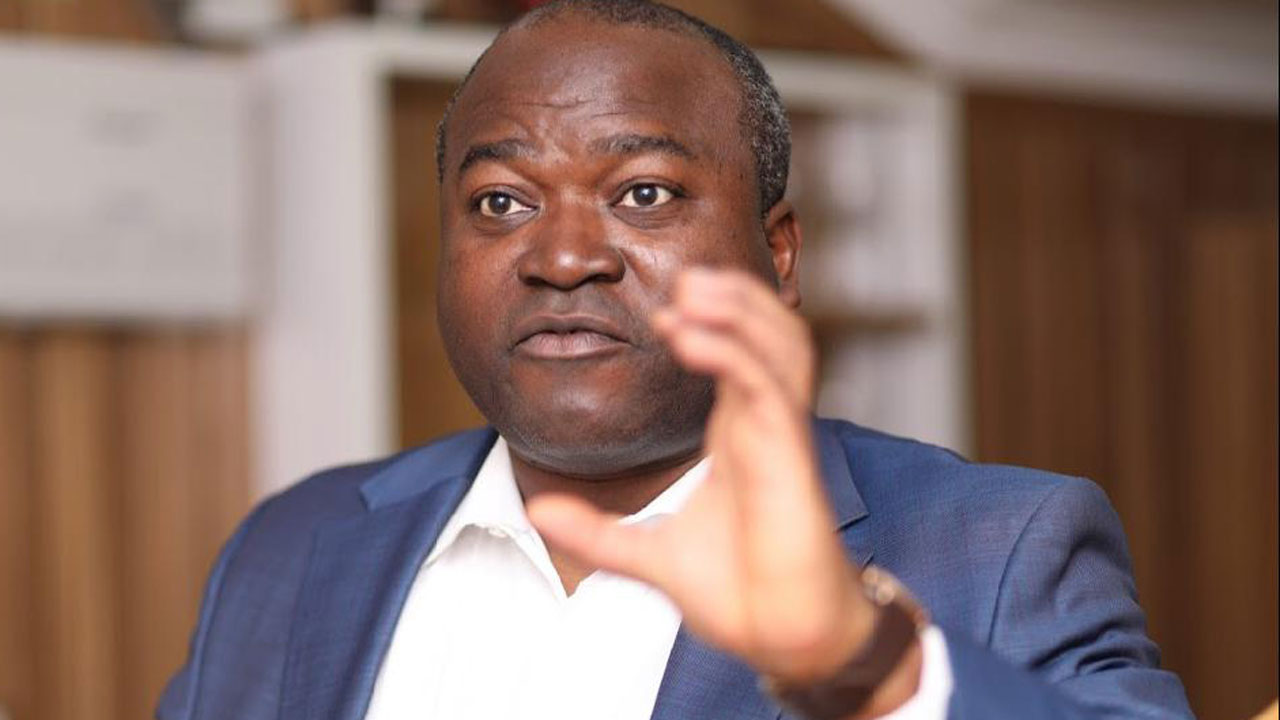

Leading digital financial institution, Polaris Bank, has assured customers, financial sector stakeholders, and regulators that the Bank passed its road to recovery years back.

Chief Executive Officer (CEO), of the financial institution, Adekunle Sonola, stated this in a recent interview, with PROSHAREs team of analysts, noting that the Bank is currently on the growth path leading to market dominance.

According to him, careful rethinking and re-strategizing corporate plans create the bedrock of competitive burst and business sustainability, both attributes that Polaris Bank has focused on in the last few years, working with professional bodies such as PwC, Ernst & Young (E&Y), and KPMG across several corporate verticals.

“The bank has travelled past the recovery road years back; it is currently on the growth road leading to market dominance.

“Adequate capitalization is a key measure of financial health, providing comfort to depositors and affording balance sheet and business growth. The bank is presently adequately capitalized, operating well above the 10% minimum requirement for National Banks. Nonetheless, we are concluding arrangements to inject Tier II capital into the Balance Sheet to support our growth aspirations. Our shareholders are ready and willing to inject Tier I capital into the books. Having instituted best-in-class risk management practices, and maintaining adequate capitalization to support our growth objectives is not one of the bank’s immediate challenges and will not be in the foreseeable future. The new owners are committed to providing necessary support towards building a strong and resilient financial position to underwrite transactional activities of the Bank for sustainable value creation,” Sonola assured.”

Confirming that the Bank now operates a two-prong ideology of controlling the funding cost and growing earning assets at economic pricing, the Polaris Bank boss noted that earning asset growth is something the Bank is driving at from both the investment and risk asset sides of the business.

“The Bank has consistently been growing its asset base year-on-year (Y-o-Y). The Bank’s recently developed strategic plan will guide the Bank to a position of being a major challenger of Tier 1 banks and be the leader among Tier II banks along all the key performance parameters. Furthermore, the bank’s focus is to be one of the most efficient deposit money institutions in the industry, delivering superior value to its stakeholders, our competition is not of size, but value creation.

“We have revamped our go-to-market structure, broadening our customer base, fine-tuning our product, and supporting service offerings, strengthening personnel sales capacities, and improving our loan onboarding processes. We are very confident our Net interest income and margin will witness considerable growth as our strategies mature.”

Clarifying that cost control is a critical part of the Bank’s tactical and strategic roadmap, Polaris Bank Managing Director said its short-term tactics come from its longer-term strategies, adding that at the tactical level, the Bank is strengthening digital deliveries, and upgrading the capabilities and offerings on Digital Bank, Vulte, for an even more intensive and intuitive experience across customer journeys.

Polaris Bank has also improved its digital play, as reflected in the improvement of technological interfaces that feed into the customer’s journey expectations and experiences.

“We intend to build a dominant digitally led retail franchise and continue to reshape the bank’s business processes and support technology to continuously improve enterprise agility. The key thing is to drive top-notch processes and build agility in customer responsiveness.

“The VULTE product is just one of our service offerings. Indeed, we are creating a digital service reality that is customer service-focused. The technology driving this will scale digital service delivery to enhance our customers’ product or service experiences as we front-load features that fit into their expectations and future possible journey outcomes. As financial service platforms get better and continue to be an enabler, a part of the fabric of our modern economy, we will be an integral part of the way people carry out their businesses and we will make their digital journeys an integrated friendly experience. One cannot talk too much about this, but the tea leaves are pointing to a fresh pathway to consumer banking satisfaction.”

Other areas of positive growth in the Bank include the creation of a more powerful customer service experience via improved staff productivity with the best of Polaris Bank staffers driving the process having gone through upskilling and retraining programmes. This ensures we are driving a productivity-sensitive framework that marries staff effort with measurable business contributions.

“We have zeroed in on offering superior customer experience as a competitive tool. The new world of competitiveness requires that corporations are agile and flexible, we are building this into the bank’s operational DNA. Our customer journey experiences have been deconstructed across demographics and the service propositions will soon grace banking halls in the next eighteen months at the latest.

“We plan for a stronger balance sheet, with higher loan quality, greater liquidity, larger capital, and resilience to absorb economic shocks. Our loan asset quality has improved significantly, thereby improving liquidity, earnings, and the bank’s capital. We are primed to improve our cost-to-income ratio (CIR), Capital Adequacy Ratio (CAR), and Cost-of-Risk ratio (CoR). In the recent past, we saw bumps in the risk area with CoR higher than we would like, but more recently risk quality has improved leading to lower CoR.”

With a focus on customer-centricity, risk management, cost optimization, and technological advancements, Polaris Bank is seen as positioning itself as a major player in the industry, offering superior customer experiences and driving financial performance.

The Bank has been decorated as Nigeria’s Digital Bank of the Year in two successive years; it aims to position itself as a dominant digitally-led retail franchise, delivering superior value to stakeholders.

Personality in Focus

Police Affairs Minister Gaidam Mourns Captain Caleb Olubolade

The Minister of Police Affairs, Senator Ibrahim, has commiserated with the family of late Navy Captain Caleb Olubolade (retd) on the death of the former military administrator.

In a condolence statement signed by the Minister himself, and made available to the National Association of Online Security News Publishers (NAOSNP), Senator Gaidam lauded the fallen soldier, saying that his contributions to nation building will not be forgotten.

Olubolade died in the early hours of Monday, May 12, 2025.

Below is the detailed message:

LETTER OF CONDOLENCE TO THE FAMILY OF THE LATE NAVY CAPTAIN CALEB OLUBOLADE (RTD)

I, the Honourable Minister of Police Affairs, Senator Ibrahim Gaidami, offer condolences to the people and government of Nigeria, especially the Olubolade family, on the death of former Minister of Police Affairs, Navy Captain Caleb Olubolade (Rtd), who died today.

The Ministry and Police community share this moment of grief and sorrow with the family, the people of the state, and the entire country. When offering condolences to a statesman, it is important to acknowledge the significance of his contributions and the impact of his passing on the nation.

We are deeply saddened by the loss of a true leader and dedicated servant to our nation. His legacy will live on through his tireless efforts and commitment to the people. This is a profound loss for our country. Captain Olubolade’s dedication to public service and his unwavering commitment to the security sector will be remembered.

Our hearts are heavy as we mourn the passing of a statesman who served with honor and integrity. May his spirit of leadership inspire generations to come.

In this time of grief, we offer our deepest condolences to the family and friends of Olukayode. His contributions to our nation will not be forgotten.

Personality in Focus

UK Varsity Honours Ogunsan with Advisory Board Membership

A Board Member of Lagos State Security Trust Fund (LSSTF), Dr. Ayo Ogunsan, has been honoured with membership status of the Centre for African Social and Economic Transformation (CASET), University of the West of England, United Kingdom.

The recognition is coming on the heels of Ogunsan’s indefatigable commitment and unrelenting advocacy and support for quality education across all levels.

Dr. Ogunsan’s unflinching interest in education glaringly shows in his active participation as Board Member of Center for Digital Humanities (CEDHUL) in Nigeria’s frontline university, University of Lagos; as Chairman of AKEM Foundation, a nonprofit which has provided millions of naira within two (2) years to support schools and NGOs who provide education access for free to children in underserved communities in Nigeria; and in several individual sponsorships to ensure that the future is brighter for children. His personal story of prominence polished out of adversity continues to propel him forward.

This commitment is well-captured in the letter of Jo Midgley, the Deputy Vice Chancellor and the Registrar of the University of the West of England, UK who communicated the news of the appointment to the advisory board.

The academic, Jo Midgley highlighted about Dr. Ogunsan, ‘Your extensive experience and contributions to Africa’s higher education sector through training university leaders and teaching personnel, as well as your Board Membership of the Centre for Digital Humanities at the University of Lagos, Nigeria will make you an invaluable member of our CASET’s Advisory Board.’

‘As a Board member, you will play a crucial role in shaping CASET’s strategic direction, providing high-level support and guidance on stakeholder engagement strategies and knowledge dissemination efforts, helping to foster impactful collaborations and partnerships, and ensuring that the Centre’s initiatives align with the evolving needs of Africa’s social and economic landscape’, the letter stated about the expectations for the technocrat Ogunsan.

The higher institution, University of the West of England, United Kingdom also added the reason for appointing Dr. Ayo Ogunsan as Member of the Advisory Board of our Centre for African Social and Economic Transformation (CASET). They noted that they are guided by the University’s ethos of enterprise and collaboration, thus ‘the Centre is dedicated to empowering individuals and communities in Africa through strategic partnerships and transformative education and training programmes, research, evidence-based policymaking, social and cultural engagement geared towards finding practical solutions to regional social and economic challenges.’

‘We will be honoured to have you as part of our highly respected and esteemed group of experts and thought leaders.’

Midgley added that the Advisory Board convenes annually, with meetings held virtually and occasionally in person at the University of the West of England UK or in Africa where feasible.

He noted that Ogunsan’s insights and participation would be instrumental in helping CASET to achieve its mission of fostering transformative social and economic change through capacity building, research priorities, evidence-based policy and innovation.

The Registral said that Advisory Board Members were not employees of the University including CASET adding that his term as a board member would commence in June 2025 and run for a renewable period of three years on a non-remuneration basis.

“Renewal of board membership is subject to members’ continuing support, integrity and commitment to always being a good ambassador in advancing CASET’s mission.

“We will be honoured to have you as part of our highly respected and esteemed group of experts and thought leaders.

“We also appreciate your willingness to contribute to our mission and look forward to your valuable contribution to advancing CASET’s vision for transformative change in Africa,” he said in the letter.

It was gathered that Ogunasn is a prominent figure in the education sector, his expertise spans entrepreneurs hip, security management, and education, and he is widely acknowledged for his visionary leadership and unwavering commitment to excellence.

Source: Trek Africa

Personality in Focus

Behold the First Ever American Pope, Robert Francis Prevost

Robert Francis Prevost, the first pope from the United States, has a history of missionary work in Peru but also a keen grasp of the inner workings of the Church.

The new Leo XIV, a Chicago native, was entrusted by his predecessor Francis, to head the powerful Dicastery for Bishops, charged with advising the pontiff on new bishop appointments.

The sign of confidence from Francis speaks to Prevost’s commitment as a missionary in Peru to the “peripheries” – overlooked areas far from Rome prioritised by Francis – and his reputation as a bridge-builder and moderate within the Curia.

The 69-year-old Archbishop-Bishop emeritus of Chiclayo, Peru, was made a cardinal by Francis in 2023 after being named Prefect of the Dicastery, one of the Vatican’s most important departments — and a post that introduced him to all key players in the Church.

Vatican watchers had given Prevost the highest chances among the group of US cardinals of being pope, given his pastoral bent, global view and ability to navigate the central bureaucracy.

Italian newspaper, La Repubblica, called him “the least American of the Americans” for his soft-spoken touch.

His strong grounding in canon law has also been seen as reassuring to more conservative cardinals seeking a greater focus on Theology.

Following Francis’s death, Prevost said there was “still so much to do” in the work of the Church.

“We can’t stop, we can’t turn back. We have to see how the Holy Spirit wants the Church to be today and tomorrow, because today’s world, in which the Church lives, is not the same as the world of ten or 20 years ago,” he told Vatican News last month.

“The message is always the same: proclaim Jesus Christ, proclaim the Gospel, but the way to reach today’s people, young people, the poor, politicians, is different,” he said.

Born on September 14, 1955, in Chicago, Prevost attended a Minor Seminary of the Order of St Augustine in St Louis as a novice before graduating from Philadelphia’s Villanova University, an Augustinian institution, with a degree in Mathematics.

After receiving a masters degree in divinity from Chicago’s Catholic Theological Union in 1982, and a doctorate decree in canon law in Rome, the polyglot joined the Augustinians in Peru in 1985 for the first of his decade-long missions in that country.

Returning to Chicago in 1999, he was made provincial prior of the Augustinians in the US Midwest and later the prior general of the order throughout the world.

But he returned to Peru in 2014 when Francis appointed him as apostolic administrator of the Diocese of Chiclayo in the country’s north.

Nearly a decade later, Prevost’s appointment in 2023 as head of the Dicastery came after Canadian Cardinal Marc Ouellet was accused of sexually assaulting a woman and resigned for age reasons.

The Vatican later dropped the case against Ouellet for insufficient evidence.

Prevost also serves as president of the Pontifical Commission for Latin America.