Headlines

Why Foreign Investors Are Leaving Nigeria – Peter Obi

By Eric Elezuo

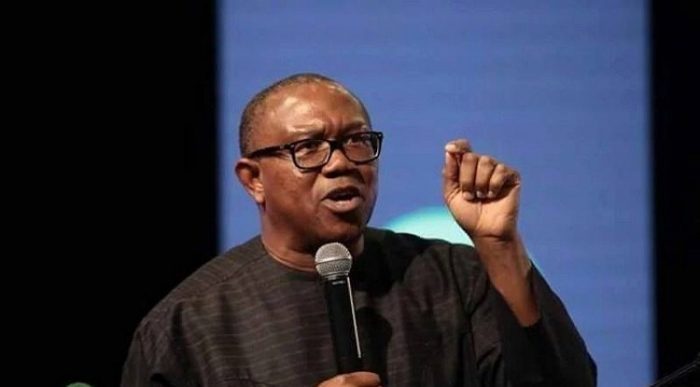

A former governor of Anambra State and Labour Party (LP) presidential candidate in the 2023 elections, Mr. Peter Obi, has given reasons foreign investors are shutting down their operations and leaving Nigeria.

He attributed the trend to a negative medium to long-term prospects strategy, unattractive investment profile and a continuous deteriorating business environment, among others.

Obi, who voiced his concerns in a series of tweets on his verified X account on Friday, tasked governments at all levels to take immediate steps towards reversing the trend and keeping strategic international investors in the country.

He said he is saddened to hear the news that multi-national consumer goods giant, Procter & Gamble (P&G), is leaving Nigeria.

The manufacturing conglomerate had announced a limited market portfolio restructuring which includes pulling out of Nigerian and Argentinian markets.

While reacting to the news, the former governor of Anambra State explained that Nigeria is scaring away multinational companies, at a time the purchasing power of most Nigerians nose-diving, the absence of the rule of law and lack of a conducive business environment, which ultimately makes it difficult to retain iconic companies let alone attract new ones.

“A few months ago, I lamented the exit of one of the top global pharmaceutical giants, GlaxoSmithKline (GSK) from Nigeria. GSK remains a top global pharmaceutical manufacturer and has had 51 years of operations in Nigeria,” Obi wrote.

“The reason for their exit was that there was no longer a perceived growth in Nigeria anchored on productivity.

“Today, Procter & Gamble (P&G), the world’s largest personnel care and household products company, makers of iconic brands like Pampers, Gillette, etc, is again leaving Nigeria, for the same reason GSK left.

“Following this also are French pharmaceutical company Sanofi-Aventis, and top Energy firm, Norwegian behemoth Equinor which has sold off its Nigerian business development associates.

“Fifteen years ago, P&G, as they are commonly called, viewed Nigeria as a strategic country of importance and invested millions of dollars in an ultra-modern chain supply structure in Agbara which, sadly, is now up for sale.

“The presence of these iconic companies in any economy is not only that they signify trust and confidence, as well as belief in the medium to long-term socio-economic prospects of such countries, but they massively create jobs, invest in Research and Development, as well as pieces of training which smaller players in the industry learn from and adapt.

“They help, to a great extent to develop local talents for both local and global jobs. The exit of these top global companies shows that our medium to long-term prospects strategy is in the negative.

“Our investment profile is not attractive and our business environment is deteriorating continually.

“The purchasing power of most Nigerians is nose-diving every day. In the face of the absence of the rule of law, and a conducive business environment, it will be difficult to retain such iconic companies and talk more about attracting new ones.”

“National greatness and development cannot be pursued in an atmosphere that is scaring away strategic international investors,” he added.

Recall that in August, pharmaceutical giant, GlaxoSmithKline packed up its businesses in the country with a promise to treat its staff fairly.

A statement to the effect, and signed by the Company Secretary, Frederick Ichekwai, stated in part, “In our published Q2 results we disclosed that the GSK UK Group has informed GlaxoSmithKline Consumer Nigeria PLC of its strategic intent to cease commercialization of its prescription medicines and vaccines in Nigeria through the GSK local operating companies and transition to a third-party direct distribution model for its pharmaceutical products.”

The company, whose primary activities include marketing and distribution of consumer healthcare and pharmaceutical products, said that its parent company, GSK Plc UK, had revealed its intent to cease commercialisation of its prescription medicines and vaccines through its Nigerian subsidiary.

A few days ago, the Chief Financial Officer of P&G, Mr. Andre Schulten, announced at the Morgan Stanley Global Consumer & Retail Conference that, “we have announced that we will turn Nigeria into an import-only market, effectively dissolving our footprint on the ground in Nigeria and reverting to an import-only model.”

Schulten, attributed the P&G’s decision exit Nigeria to the prevailing foreign exchange rate situation in the country, saying that Nigeria and Argentina were difficult to do business in because of macroeconomic environment.

He stated that, “the other reality that arises in some of these markets is that it gets increasingly difficult to operate and create U.S dollar value. So when you think about places like Nigeria and Argentina, it is difficult for us to operate because of the macroeconomic environment.

“So with that in mind, we are announcing a restructuring program with the intent to adjust operating model and adjust the portfolio to ensure that we maintain the portfolio discipline that has brought us to this point.

“The restructuring program will largely focus on Nigeria and Argentina. We’ve announced that we will turn Nigeria into an import-only market, effectively dissolving our footprint on the ground in Nigeria and reverting to an import-only model.”

He explained that Nigeria was a $50 million net sales business which would not make any significant marginal impact on the P&Gs overall portfolio worth $85 billion.

Mr. Peter Obi has been in the forefront of critiquing the policies of the President Bola Tinubu-led administration.

Headlines

Court Empowers Tinubu to Implement New Tax Law Effective Jan 1

An Abuja High Court has cleared the way for the implementation of Nigeria’s new tax regime scheduled to commence on January 1, 2026, dismissing a suit seeking to halt the programme.

The ruling gives the Federal government, the Federal Inland Revenue Service (FIRS) and the National Assembly full legal backing to proceed with the take-off of the new tax laws.

The suit was filed by the Incorporated Trustees of African Initiative for Abuse of Public Trustees, which dragged the Federal Republic of Nigeria, the President, the Attorney-General of the Federation, the President of the Senate, Speaker of the House of Representatives and the National Assembly before the court over alleged discrepancies in the recently enacted tax laws.

In an ex-parte motion, the plaintiff sought an interim injunction restraining the Federal Government, FIRS, the National Assembly and related agencies from implementing or enforcing the provisions of the Nigeria Tax Act, 2025; Nigeria Tax Administration Act, 2025; Nigeria Revenue Service (Establishment) Act, 2025; and the Joint Revenue Board of Nigeria (Establishment) Act, 2025, pending the determination of the substantive suit.

The group also asked the court to restrain the President from implementing the laws in any part of the federation pending the hearing of its motion on notice.

However, in a ruling delivered on Tuesday, Justice Kawu struck out the application, holding that it lacked merit and failed to establish sufficient legal grounds to warrant the grant of the reliefs sought.

The court ruled that the plaintiffs did not demonstrate how the implementation of the new tax laws would occasion irreparable harm or violate any provision of the Constitution, stressing that matters of fiscal policy and economic reforms fall squarely within the powers of government.

Justice Kawu further held that once a law has been duly enacted and gazetted, any alleged errors or controversies can only be addressed through legislative amendment or a substantive court order, noting that disagreements over tax laws cannot stop the implementation of an existing law.

Consequently, the court affirmed that there was no legal impediment to the commencement of the new tax regime and directed that implementation should proceed as scheduled from January 1, 2026.

The new tax regime is anchored on four landmark tax reform bills signed into law in 2025 as part of the Federal Government’s broader fiscal and economic reform agenda aimed at boosting revenue, simplifying the tax system and reducing leakages.

The laws — the Nigeria Tax Act, 2025, Nigeria Tax Administration Act, 2025, Nigeria Revenue Service (Establishment) Act, 2025, and the Joint Revenue Board of Nigeria (Establishment) Act, 2025 — consolidate and replace several existing tax statutes, including laws governing companies income tax, personal income tax, value added tax, capital gains tax and stamp duties.

Key elements of the reforms include the harmonisation of multiple taxes into a more streamlined framework, expansion of the tax base, protection for low-income earners and small businesses, and the introduction of modern, technology-driven tax administration systems such as digital filing and electronic compliance monitoring.

The reforms also provide for the restructuring of federal tax administration, including the creation of the Nigeria Revenue Service, to strengthen efficiency, coordination and revenue collection across government levels.

While the Federal government has described the reforms as critical to stabilising public finances and funding infrastructure and social services, the laws have generated intense public debate, with some civil society groups and political actors alleging discrepancies between the versions passed by the National Assembly and those later gazetted.

These concerns sparked calls for suspension, re-gazetting and legal action, culminating in the suit dismissed by the Abuja High Court.

Reacting to the judgment, stakeholders described the ruling as a major boost for the reforms, saying it has removed all legal obstacles that could have delayed the implementation of the new tax framework.

Headlines

Peter Obi Officially Dumps Labour Party, Defects to ADC

Former governor of Anambra State, presidential candidate of the Labour Party (LP) in the 2023 election, Mr. Peter Obi, has officially defected to the coalition-backed African Democratic Congress (ADC).

Obi announced the decision on Tuesday at an event held at the Nike Lake Resort, Enugu.

“We are ending this year with the hope that in 2026 we will begin a rescue journey,” Obi said.

The National Chairman of the ADC, David Mark, was among the attendees.

Headlines

US Lawmaker Seeks More Airstrikes in Nigeria, Insists Christian Lives Matter

United States Representative Riley Moors has said further military strikes against Islamic State-linked militants in Nigeria could follow recent operations ordered by President Donald Trump, describing the actions as aimed at improving security and protecting Christian communities facing violence.

Moore made the remarks during a televised interview in which he addressed U.S. military strikes carried out on Christmas Day against militant targets in North-west Nigeria.

The strikes were conducted in coordination with the Nigerian government, according to U.S. and Nigerian officials.

“President Trump is not trying to bring war to Nigeria, he’s bringing peace and security to Nigeria and to the thousands of Christians who face horrific violence and death,” Moore said.

He said the Christmas Day strikes against Islamic State affiliates had provided hope to Christians in Nigeria, particularly in areas affected by repeated attacks during past festive periods.

According to U.S. authorities, the strikes targeted camps used by Islamic State-linked groups operating in parts of north-west Nigeria.

Nigerian officials confirmed that the operation was carried out with intelligence support from Nigerian security agencies as part of ongoing counter-terrorism cooperation between both countries.

The United States Africa Command said the operation was intended to degrade the operational capacity of extremist groups responsible for attacks on civilians and security forces.

Nigerian authorities have described the targeted groups as a threat to national security, noting their involvement in killings, kidnappings and raids on rural communities.

Moore said the strikes marked a shift from previous years in which attacks were carried out against civilians during the Christmas period. He said the U.S. administration was focused on preventing further violence by targeting militant groups before they could launch attacks.

U.S. officials have said the military action was carried out with the consent of the Nigerian government and formed part of broader security cooperation between the two countries. Nigeria has received intelligence, training and logistical support from international partners as it seeks to contain militant activity.

Moore had previously called for stronger international attention to attacks on Christian communities in Nigeria and has urged continued U.S. engagement in addressing extremist violence. He said further action would depend on developments on the ground and continued coordination with Nigerian authorities.

Nigerian officials have maintained that counter-terrorism operations are directed at armed groups threatening civilians, regardless of religion, and have reiterated their commitment to restoring security across affected regions.