Business

FirstBank Presents Devices to Lagos Govt to Enhance E-learning for Students

First Bank of Nigeria Limited, Nigeria’s leading financial inclusion services provider on Thursday, 11 June 2020, presented 20,000 units of e-learning devices to the Lagos State government at the State House in Marina, Lagos. The devices are planned for distribution to school children.

With the gesture, the Lagos State governor, Babajide Sanwo-Olu said the State had found a “real development partner” in FirstBank, noting that the intervention came at a time the Government was massively deploying technology to transform the conventional mode of teaching and learning.

The presentation of these devices which is also in partnership with Robert & John (an edu-tech company that owns Roducate) is part of activities implemented to close the gap caused by the disruption in children education’s due to schools’ closure, following the COVID-19 pandemic. So far the Bank has enabled over 10,000 free sign-ups to the Roducate e-learning platform with the goal to empower one million students.

“When we were developing our vision to change the face of education in Lagos, we knew from the outset that we could not achieve much progress in improving the quality of learning without using technology as a strong enabler. So, it is not out of place that we are witnessing more infusion of technology in learning and this intervention by FirstBank could not have come at a better time,” said Babajide Sanwo-Olu, the Governor of Lagos State.

“It feels great when you have people and organisations share in your vision and working with you to realise it. I’m glad to say that we have found a real development partner in FirstBank, which has supported us to actualise the vision we have signed to achieve. Many years back, nobody foresaw Coronavirus (COVID-19) would come and disrupt our ways of life. These devices will be useful to our pupils in the current circumstances we have found ourselves.”

“FirstBank and all technical partners that worked on this project have written their names in the heart of students that will be using the device to learn. They will be forever grateful for passing the future to them.”

The e-learning device is configured in line with the government’s accredited curriculum for primary, secondary and tertiary schools across various fields of academic endeavours, such as science, commercial and arts. It is built to promote cost-effective learning as there is minimal need for internet connectivity, whilst learning on the device is on-going.

Speaking on the presentation, Dr. Adesola Adeduntan, Chief Executive Officer, First Bank of Nigeria Limited said “the e-learning initiative aligns with our Corporate Responsibility and Sustainability initiatives and falls under one of our key strategic pillars, Education.”

“We are excited to promote education and have consistently demonstrated this in our support of 10 universities and 3 secondary schools on infrastructure projects; our support of 10 universities with professorial Chairs and provision of financial literacy, entrepreneurial and career counselling to over 80,000 students in over 80 secondary schools in the country”, he added.

The Bank has also collaborated with IBM and Curious Learning to ensure the e-learning initiative swiftly moves across the country to school children and individuals with the need to promote the pursuit of knowledge, irrespective of age.

The partnership with IBM, offers the Digital-Nation Africa program, an online youth-focused learning programme that enables innovation and skills development on emerging technologies through focus areas such as Artificial Intelligence, Coding, Cloud, Internet of Things, Blockchain, Data Science and Analytics, and Cybersecurity whilst Curious Learning offers academic-based contents for students aged 3-8, using fun, self-guided learning apps to help them with their cognitive skills at a fundamental level.

Business

FirstBank Integrates PAPSS into LIT App for Seamless Cross-Border Payments in Africa

Premier bank in West Africa and a leading financial inclusion service provider, FirstBank, has announced the successful integration of the Pan-African Payment and Settlement System (PAPSS) into its flagship digital banking platform, the LIT app, enabling customers to make instant, secure, and local currency-based cross-border payments across Africa.

PAPSS, developed by the African Export-Import Bank (Afreximbank) in collaboration with the African Union and the AfCFTA Secretariat, enables instant, low-cost payments in local currencies between African countries.

Speaking on the integration, the Group Executive, e-Business and Retail Products at FirstBank, Chuma Ezirim, said, “The integration of PAPSS into the LIT app is a testament to FirstBank’s commitment to delivering innovative, customer-centric solutions that simplify and enhance financial transactions. This milestone aligns with the Bank’s strategic goal of deepening digital capabilities and expanding access to seamless cross-border payment services across Africa.”

Commenting on this collaboration, Mike Ogbalu, CEO of PAPSS said, “Every time an individual, an SME or a Company sends money instantly within Africa in their own currency, we are not just moving funds, we are connecting ambitions, supporting livelihoods, and bridging dreams across borders. This collaboration with FirstBank and their LIT app brings us a step closer to making African borders invisible to movement of money, so that the continent’s entrepreneurs and families can focus on what matters most: building their future, not battling payment barriers.”

The LIT App, FirstBank’s innovative digital banking platform, offers a wide range of features including virtual cards, scheduled payments, and multiple transfers in one go, designed to meet the dynamic needs of customers. The addition of PAPSS expands its capabilities to support cross-border commerce, especially for individuals and SMEs engaged in pan-African business.

With PAPSS now live on the LIT App, FirstBank is breaking down barriers to payments, trade and financial inclusion across Africa. Customers can now send funds conveniently to other countries in Naira, without needing US dollar, GBP or Euro conversions. This landmark integration enables real-time cross-border payments in local African currencies, reduces transaction costs, and improves settlement efficiency. It also expands access to digital banking services, promotes financial inclusion, supports SMEs and fosters growth under the African Continental Free Trade Area (AfCFTA).

This integration of PAPSS to the LIT app reinforces FirstBank’s leadership in digital banking innovation and supports the African Continental Free Trade Area (AfCFTA) agenda by simplifying intra-African transactions.

Business

Lemon Friday Plus: Adron Home Fetes Customers with Mouthwatering Goodies, Discounts

Nigeria’s leading real estate company renowned for making homeownership affordable for all, Adron Homes and Properties, has unveiled the much-anticipated Lemon Friday Plus Promo; an upgraded version of its annual Lemon Friday campaign.

The Lemon Friday Plus Promo is designed to make property ownership easier, more flexible, and more rewarding for Nigerians both at home and in the Diaspora. With discount of up to 50% on all landed properties, flexible payment structures, and exciting gift packages, Adron Homes continues to fulfill its mission of providing affordable housing solutions nationwide.

According to the company’s Group Managing Director, Mrs Adenike Ajobo, the Lemon Friday Plus Promo was introduced as part of Adron Homes’ commitment to empower more Nigerians to become landowners despite the current economic challenges.

“For over a decade, we have continued to make property ownership possible for everyday Nigerians. Lemon Friday Plus takes that vision even further by making payments more flexible and the process of owning land more convenient and rewarding,” he said.

For the first time, subscribers can spread their initial deposits into five convenient installments, from July to November 30, 2025. This unique feature allows individuals and families to plan their finances while securing a plot in any Adron Homes estate of their choice.

The promo offers affordable entry options with tiered deposit packages:

* ₦300,000 (Bronze)

* ₦500,000 (Silver) – includes a cockerel & rice

* ₦1,000,000 (Gold)

* ₦3,500,000 (Diamond)

Each deposit category comes with exciting gift rewards, ranging from home appliances such as refrigerators, washing machines, and home theatres, to even cows for festive celebrations.

During the promo period, customers can enjoy a massive 50% discount on all Adron Homes estates nationwide and spread their remaining balance conveniently over 12 months.

This offer applies to all Adron Homes estates, including popular developments such as Treasure Park and Gardens (Shimawa), City of David Estate (Abeokuta), Grandview Park and Gardens (Atan-Ota), Manhattan Park and Gardens (Karshi, Abuja), among others.

With over 60 estates across Nigeria, Adron Homes provides customers the opportunity to own land in Lagos, Ogun, Abuja, Oyo, Osun, Niger, Nasarawa, Ekiti, and Plateau States.

Speaking further, the Managing Director, Mrs. Adenike Ajobo, who officially declared the Lemon Friday Plus sales open at the company’s Ibadan regional office, emphasized that the campaign underscores Adron Homes’ goal of building cities and creating affordable housing opportunities.

“This promo is not just about discounts; it’s about making real estate accessible to everyone; traders, salary earners, entrepreneurs, and even students. At Adron Homes, we believe everyone deserves a place to call home,” she noted.

The Lemon Friday Plus Promo is currently open to new and existing customers nationwide. Interested buyers can visit any Adron Homes regional office, call the company’s hotlines, or connect via its official website and social media handles to take advantage of this limited-time offer.

Business

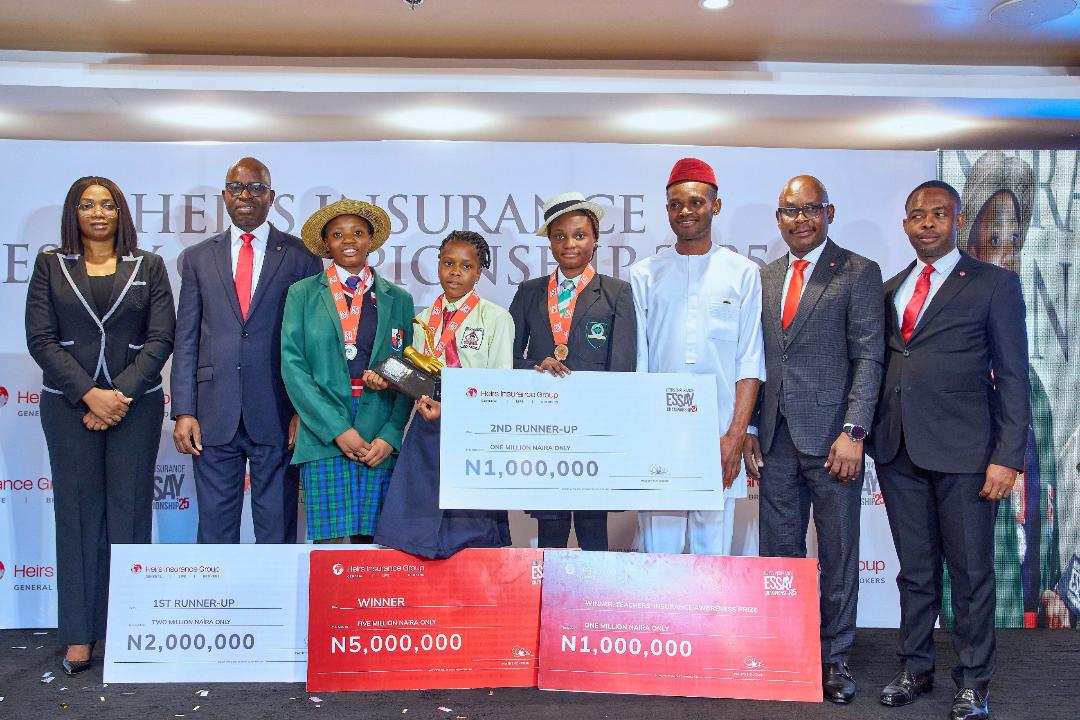

Rhema-Love Abraham, 13, Wins 2025 Heirs Insurance Essay Championship

Heirs Insurance Group, Nigeria’s fastest-growing insurance group, has announced the winners of the 4th edition of the Heirs Insurance Essay Championship, a nationwide competition promoting financial literacy and academic excellence among secondary school students and educators.

The grand finale, held at the Transcorp Hilton Hotel, Abuja, brought together students, parents, and academic leaders for a celebration of knowledge and creativity. This year’s edition, which attracted over 5,000 entries from junior secondary school students nationwide, was anchored on the topic “The Role of Insurance in Keeping Families Safe and Secure”.

After a rigorous evaluation process by a distinguished panel of academic professionals, independently verified by Deloitte & Touche, 13-year-old Rhema-Love Abraham of Precepts Learning Field, Lagos, emerged as the overall winner, earning a ₦5 million scholarship and a ₦1 million grant for her school.

Bernice Michael of S-TEE High School, Lagos, claimed the second-place position, winning a ₦2 million scholarship, while Afopefoluwa Tofio-Jacobs of D-IVY College, Ogun State, took third place, receiving a ₦1 million scholarship.

This year, Heirs Insurance introduced the inaugural Teachers Prize, to honor teachers promoting insurance awareness within their schools and communities. This initiative was created to democratise access to insurance literacy, working collaboratively with teachers and educators.

Mr. Okpe James Chidi, a teacher at Urban Secondary School, Umuna Orlu, Imo State, emerged as the winner of the Teachers’ Insurance Awareness Prize, with a personal award of ₦1 million cash prize, and a ₦500,000 grant for his school. His project, which deepened students’ understanding of financial literacy and insurance, was praised for its innovation, reach, and measurable impact.

Speaking at the ceremony, Niyi Onifade, Sector Head, Heirs Insurance Group, commended all the participants for their creativity and drive, emphasising the Group’s commitment to nurturing future leaders through education.

He said, “We are proud of every student and teacher who participated in this year’s Essay Championship. Their creativity, curiosity, and dedication reflect the future we envision for our nation; one built on knowledge, innovation, and resilience. At Heirs Insurance Group, we believe financial literacy is a powerful tool for empowerment and transformation”.

The Heirs Insurance Essay Championship is a flagship Corporate Social Responsibility (CSR) initiative of Heirs Insurance Group, created to build awareness of insurance literacy and critical thinking among young Nigerians. The introduction of the Teachers’ Insurance Awareness Prize further demonstrates the Group’s commitment to advancing insurance education and promoting financial inclusion at every level of society.