Business

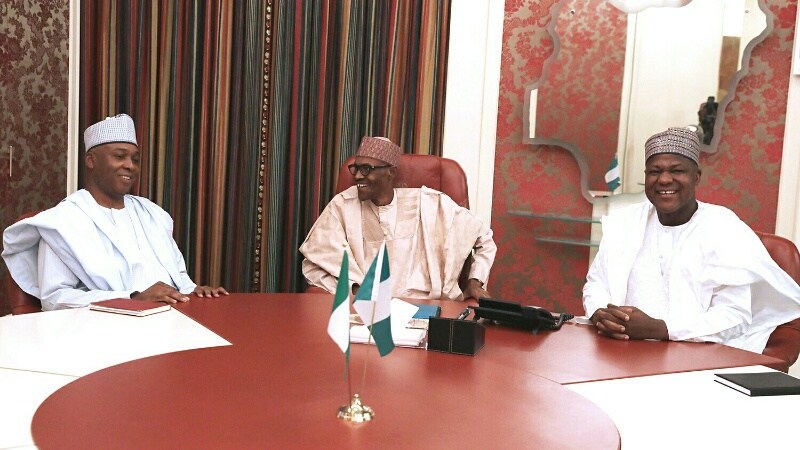

NASS Passes N8.916tn Budget, Proposes N23.7bn for Lawmakers’ Severance

The National Assembly on Tuesday passed the 2019 Appropriation Bill, raising the size by about N17bn from the N8.83tn proposed by the Executive to N8.916tn, with N23.7bn earmarked for lawmakers’ severance gratuities and allowances.

The key components of the budget, as passed by the parliament, include N502,058,892,965 for statutory transfers, against the N492.36bn proposed; N2,254,014,113,092 for debt service, against the proposed N2.14tn; N4,055,940,383,684 for recurrent (non-debt) expenditure, against the proposed N4.04tn.

Although a sinking fund of N120bn was proposed for the retirement of maturing bonds to local contractors, the lawmakers approved N110bn.

While the sum of N2.031tn (including capital supplementation but excluding the capital component of statutory transfers) was proposed, the lawmakers approved N2,094,950,709,632 “for contribution to the Development Fund for Capital Expenditure for the year ending on December 31, 2019.”

The Senate and House of Representatives Committees on Appropriations, in their reports considered concurrently by the chambers, had recommended a total budget estimate of N8,906,964,099,373.

Both the Senate and the House of Representatives, however, resolved to add N10bn to the Service Wide Vote for the rehabilitation of Zamfara State over the destructions caused by bandits in the North-West state.

The lawmakers also raised the amounts voted to other items in the budget, raising the total proposed amount of N8,826,636,578,915 to N8,916,964,099,373, a difference of about N90.3bn.

A close observation of the estimates passed by the House showed that under Statutory Transfers, the National Assembly raised its budget from the proposed N125bn to N128bn. The legislature got N139.5bn appropriation in 2018.

Under Recurrent (Non-Debt) Expenditure, N1bn was voted for severance benefits to retired heads of government agencies and parastatals, and N2.3bn for the entitlements of former Presidents/Heads of State, Vice-Presidents and Chiefs of General Staff.

Also, about N23.7bn will be spent on “severance gratuity for outgoing legislators and legislative aides, allowances for incoming legislators and legislative aides, and induction programme/inauguration of the Ninth Assembly.”

The sum of N22,682,832,166 was appropriated for the payment of outstanding terminal benefits of Nigerian Airways’ ex-workers.

Operation Lafiya Dole and other special operations by the Armed Forces got N75bn.

Under the executive sub-column, the Presidency will get N430.8bn for recurrent and N18bn for capital expenditures.

Earlier during consideration of the bill at the House, a member from Kano State, Mr Damburam Nuhu, noted the large amount allocated to the Office of the National Security Adviser as against what came to sections of the National Assembly. He said it was important for Nigerians to note that one office got as much as N86bn.

The Punch

Business

Fidelity Bank Champions Tree Planting Initiative at Lagos Beach

Fidelity Bank Plc, a leading financial institution, has partnered with Greenfingers Wildlife Initiative to plant trees at Elegushi Beach, Lekki, in Lagos.

Speaking during the event, Dr Meksley Nwagboh, the Divisional Head, Brand and Communications of Fidelity Bank Plc, highlighted the bank’s resolve to consistently champion initiatives that preserve the environment and reduce the impact of climate change.

“Environmental preservation is a key Corporate Social Responsibility (CSR) pillar for us at Fidelity Bank. We believe that protecting the earth is a shared responsibility.

“That is why this initiative is not a one-time activity, but part of our ongoing efforts to promote sustainable best practices.

“We are committed to ensuring that our environment, including marine habitats, remains protected from pollution and degradation,” Nwagboh said.

In addition to planting trees, the Fidelity Bank team also conducted a beach clean-up exercise to remove waste materials from the shoreline and surrounding marine areas.

Nwagboh noted that the bank continues to support environmental conservation through various initiatives nationwide and remains a proud partner of the Nigerian Conservation Foundation (NCF).

“Tree planting is an integral part of our climate action and resilience plan, and our goal is to consistently expand our environment-friendly operations.

“We are delighted for this partnership with Greenfingers Wildlife Initiative. It is one we intend to nurture, as we believe there’s more to be done to protect our environment,” Nwagboh added.

In his speech, Mr Chinedu Mogbo, the Founder of Greenfingers Wildlife Initiative, commended Fidelity Bank for its proactive commitment to environmental sustainability.

He explained that the partnership aligns with the NGO’s mission to foster safer, cleaner environments for both humans and wildlife.

“Our partnership with Fidelity Bank is driven by a shared mission to create a safer, greener environment for both humans and wildlife. Beyond enhancing environmental safety, planting trees contributes to beautifying our surroundings and restoring balance to nature,” Mogbo stated.

The exercise marks another significant step in Fidelity Bank’s environmental CSR efforts aimed at promoting sustainable living across communities, combating climate change, protecting biodiversity, and conserving aquatic ecosystems.

Ranked among the best banks in Nigeria, Fidelity Bank Plc is a full-fledged Commercial Deposit Money Bank serving over 9.1 million customers through digital banking channels. The bank has 255 business offices in Nigeria and United Kingdom subsidiary, FidBank UK Limited.

Business

Digital Banking: Unity Bank Unveils Enhanced Unifi Mobile App

Nigeria’s retail lender, Unity Bank Plc, has launched an upgraded version of its mobile banking platform, Unifi, as part of ongoing efforts to improve customer experience on the Bank’s digital Banking platform and reinforce its proposition in ebusiness.

The latest update, Unifi version 2.3, introduces a suite of improved features designed to enhance usability, security, and convenience for customers. Key upgrades include enhanced security protocols, expanded quick-action functionalities, improved bill payment options, and an updated Nigeria Quick Response (NQR) feature to support faster and more secure QR code transactions.

A key aspect of the rollout builds on the Bank’s continued investment in digital and security infrastructure, aimed at safeguarding customer data, ensuring secure payments and enabling safe, real-time transactions across channels.

Speaking on the upgrade, Adenike Abimbola, Divisional Head, Retail, SME, Digital Banking & Fintech Partnerships at Unity Bank, said the improvements are built on the back of continuous interrogation of the platform to be more responsive to customer feedbacks which are being received overtime in our interactions and engagements.

“Digital banking has become an integral part of everyday life, particularly for retail customers who expect speed, dependability, convenience, and security as standard. With the latest upgrade to Unifi, we are responding directly to these expectations by enhancing functionality, strengthening security, and simplifying key payment and transaction journeys. Our goal is to ensure that customers can carry out their banking activities seamlessly, confidently, and without friction, anytime and anywhere.”

She added that the Bank remains committed to continuous improvement of its digital channels in line with evolving customer needs and emerging industry trends.

“As mobile banking increasingly defines how people interact with financial services, Unifi is central to our strategy of delivering intuitive, reliable, and inclusive digital solutions. We will continue to invest in technology partnerships and platform enhancements that support financial inclusion, drive adoption, and improve overall customer experience.”

Originally introduced as part of Unity Bank’s strategic push to expand its retail footprint, particularly among young and digitally savvy customers, Unifi has grown into a core engine of the Bank’s retail banking expansion. The platform plays a critical role in driving customer acquisition, deepening engagement, and reinforcing Unity Bank’s broader digital transformation agenda.

The Unifi mobile app is available for download on Android and iOS devices, offering customers access to a wide range of services, including transfers, bill payments, airtime purchases, and QR-enabled transactions.

Business

Unity Bank Disburses N270m to Corpreneurship Winners

Unity Bank Plc has disbursed over N270 million in grants to young Nigerian entrepreneurs under its Youth Entrepreneurship Development Initiative: Corpreneurship Challenge, bringing the total number of beneficiaries since inception in 2019 to 608 corps members nationwide.

The initiative, implemented in partnership with the National Youth Service Corps (NYSC) through its Skill Acquisition and Entrepreneurship Development (SAED) programme, continues to equip fresh graduates with the funding, confidence, and support required to launch and scale viable businesses.

In the most recent edition of the Corpreneurship Challenge, held between November 18 and December 9, 2025, across 10 NYSC orientation camps nationwide, 30 youth corps members emerged as winners during the Batch C, Stream I, 2025 exercise of the programme.

The latest beneficiaries were selected from orientation camps in Lagos, Delta, Kaduna, Jigawa, Kwara, Enugu, Abia, the Federal Capital Territory (FCT), Akwa Ibom, and Plateau (Jos), after pitching innovative business ideas across diverse sectors of the economy.

Unity Bank’s cumulative investment in the Corpreneurship Challenge underscores the Bank’s long-standing commitment to youth empowerment, MSME development, and job creation in Nigeria.

Speaking on the continued impact of the initiative, Unity Bank’s Divisional Head, Retail & SME, Mrs. Adenike Abimbola, reaffirmed the Bank’s belief in entrepreneurship as a catalyst for economic transformation.

“At Unity Bank, we recognise that entrepreneurship remains one of the most effective tools for tackling youth unemployment and driving inclusive economic growth. Through the Corpreneurship Challenge, we are not only providing financial support, but also instilling confidence in young graduates to transform viable ideas into sustainable businesses. Reaching over 600 beneficiaries since inception reinforces our belief in the immense potential of Nigeria’s youth,” she said.

Mrs. Abimbola further emphasised the programme’s role in strengthening Nigeria’s MSME ecosystem and creating long-term economic value.

“Small and medium-scale enterprises are the backbone of any resilient economy. By supporting corps members at the earliest stage of their entrepreneurial journey, we are helping to build businesses that can create jobs, stimulate local economies, and contribute meaningfully to national development. Our focus is on impact that goes beyond grants, impact that translates into lasting livelihoods,” she added.

The Corpreneurship Challenge provides a competitive platform where corps members pitch business ideas, assessed on originality, feasibility, market demand, scalability, and job-creation potential. Successful participants receive financial grants to kick-start or expand their ventures, alongside exposure to business guidance and mentorship.

Since its launch, the initiative has supported youth-led businesses across value chains, including fashion, agribusiness, food processing, creative services, manufacturing, and retail. Over the years, it has become an integral part of the NYSC experience, attracting thousands of applications annually and earning national recognition for its contribution to youth empowerment.

By sustaining and expanding the Corpreneurship Challenge, Unity Bank continues to reinforce its role as a strategic partner in Nigeria’s entrepreneurial and MSME development landscape.