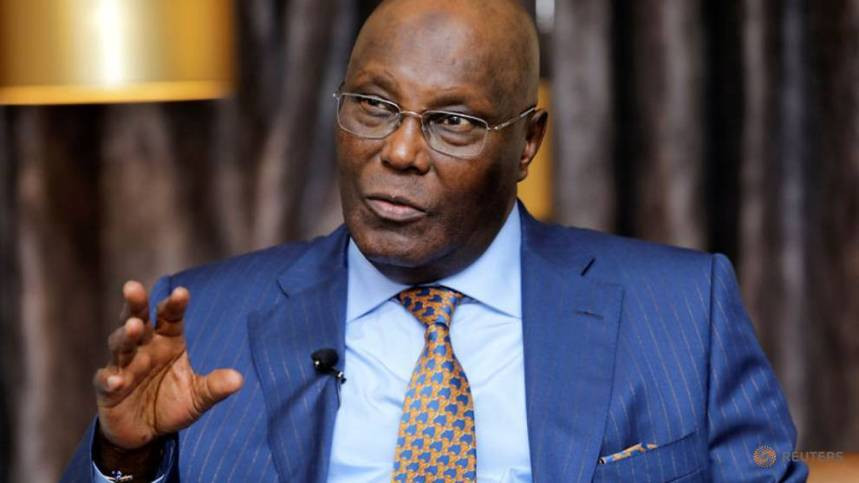

Barring unforeseen circumstances, the Labour Party (LP) Presidential Candidate in the 2023 elections, Mr. Peter Obi, is set to formally join the African Democratic Congress (ADC) on December 31, 2025.

The development would put to rest months of speculation about where the former Governor of Anambra State would pitch his tent in the coming elections.

Reports claim that Obi would be defecting with serving senators and other lawmakers elected on the platform of the LP, as well as remnants of the Peoples’ Democratic Party (PDP) in the South East region.

Specifically, Obi would be defecting alongside the Senator representing Anambra Central, Victor Umeh; that of Anambra North, Tony Nwoye; Abia South, Enyinnaya Abaribe; PDP chieftain Ben Obi; and members of the Obidient movement in the region.

It is not clear if the Abia State governor, Alex Otti, is part of the planned movement to the ADC.

The governor was recently approached by the PDP to join the party and re-contest his current position in 2027.

Further reports quoted Obi’s spokesperson, Valentine Obienyem, as confirming the planned defection of his boss to the ADC.

“Yes, it is true,” he reportedly said on Sunday.

Senator Umeh said the event would hold in Enugu, adding that it would involve all Obi’s supporters across the South East region.

“They will come from Abia, Anambra, Ebonyi and Imo states to join those in Enugu, where this exercise will hold on 31st December,” he reportedly added.

Sources hinted that Obi, who has not hidden his intention to appear on the ballot in 2027, would contest the presidential ticket of the ADC.

On his part, Chief Chekwas Okorie, reportedly said that the expected formal defection of Obi to the ADC is a healthy development that could reshape the thinking and permutations of the 2027 general elections.

“I imagine that he would be defecting along with most of his associates and followers. I believe that a fortified and strong ADC will add value to the opposition and assuage the general fear of a possible one-party option to Nigerians come 2027. The APC, ADC and possibly the PDP locking horns in the 2027 democratic encounter promises a vibrant and robust electioneering campaign that will provide Nigerians the required options to make informed choices in electing their preferred leaders at all levels. I imagine that the APC leadership will return to the drawing table to map out the strategy to confront the emerging challenge. Nigerians are in interesting times,” Okorie stated.

National President of Njiko Igbo Forum (NIF), Rev Okechukwu Obioha, vouched support for Obi to ensure he reaches the pinnacle of his political career. He, however, cautioned that the ADC should not compromise merit and integrity in the choice of its presidential candidate, stressing that Obi remains the “hope for the restoration of the country on the path of greatness.”