Business

CEOs Brainstorm on Creating Shared Value for Sustainable Business Practice

Shared Value Africa (SVA), in collaboration with Lagos Business School Sustainability Centre and ZER Consulting Africa, proudly hosted the CEO Connect Forum Nigeria and the official launch of Shared Value Nigeria.

The event was convened to foster dialogue among CEOs and business leaders on integrating the Creating Shared Value (CSV) approach to sustainability as a fundamental business strategy in Nigeria and beyond.

The forum was held in person at The Wheatbaker Hotel in Ikoyi, Lagos on Wednesday, June 26, 2024, providing a unique opportunity for high-level business executives to engage and discuss leveraging societal challenges as avenues for business innovation and growth through the CSV framework. The event featured keynote addresses and discussions from esteemed local and continental leaders, who shared practical perspectives on embedding shared value into business operations.

Tiekie Barnard, CEO and Founder of Shift Impact Africa and Shared Value Africa set the tone of the forum. She emphasised that creating shared value can be a game changer for Africa. “Shared Value Africa was started six years ago with the aim of strategically addressing societal challenges through a business management concept developed by Professors Michael Porter and Mark Kramer at Harvard. Shared value is first and foremost about profitability and not CSR or philanthropy. Businesses should serve all stakeholders, not just shareholders, weaving its purpose around the intersection of people, profit, and planet,” she said. She added that, “The CSV approach can enhance reputation, attract investment, and is a long-term commitment to addressing societal issues. It is our dream at Shared Value Africa for every organisation on the continent to practise shared value.”

Adeolu Adewumi-Zer, Founder of ZER Consulting Africa and CEO, Shared Value Nigeria, spoke on ‘Value Creation as a Business Imperative.’ She shared her discovery of shared value three years ago, pointing how it connects profit with purpose. “Shared value offers a bridge to sustainable growth, providing long-term profitability while addressing societal needs. Launching Shared Value Nigeria will foster partnerships, enabling businesses to achieve success while improving the Nigerian society and economy.”

Rashidat Adebisi, Chief Client Officer at AXA Mansard, who were major sponsors, addressed the importance of responsibility towards future generations and stakeholders. She mentioned that at AXA Mansard, they have redefined their purpose to focus on inclusion and biodiversity. “One of the biggest challenges we should address is what do we leave for the next generation. How do we ensure that we are responsible for our stakeholders? At Axa Mansard we did rethink our purpose to ensure that we are doing what matters. Purpose is beyond making money for us, our purpose is hinged on two key pillars which are inclusion and biodiversity. We have run programmes with women like the SHE Initiative to ensure that our business accommodates more women and we are working with other organisations to create more shared value in critical sectors like healthcare,” she said. Programmes such as the SHE Initiative have demonstrated the value of including more women in business, increasing their participation from 15 to 34 percent. AXA Mansard continues to work with organisations to create more shared value in healthcare, defining, mapping, and partnering to ensure their activities create value.

Karen Basiye, Director of Sustainable Business and Social Impact at Safaricom delivered the first keynote speech themed, ‘The Business Case for Shared Value.’ She indicated that businesses can create shared value by leveraging resources and expertise to tackle societal challenges, resulting in mutual benefits. Examples from Safaricom include the mobile money initiative, M-PESA in Kenya which revolutionised digital mobile money payments and installing masts in refugee camps, both of which have driven profits and societal benefits. Safaricom also created a mobile health wallet for specific health savings, reinforcing the importance of responsibility towards people and the planet.

Jessica Chivinge, Chief Strategy and Commercial Officer at Vitality Health International, spoke through her presentation themed, ‘The Pursuit of Shared Value in the Health Sector.’ She highlighted Vitality’s approach to shared value through client, employee, and societal initiatives. She added that engaging employees to innovate and rewarding clients for healthy lifestyles were key strategies that unlocked value across the entire value chain.

The event concluded with an engaging Q&A session, where the audience interacted with the speakers and shared reflections, learnings and implementable actions. The CEO Connect Forum was proudly supported by AXA Mansard, Zenith Bank Plc, Wema Bank Plc, Unilever Nigeria and Nestlé Nigeria.

Lagos Business School is Africa’s leading management education institution and the LBS Sustainability Centre is a globally recognised knowledge hub that brings together the theory and practice on business and sustainability for the advancement of business performance and development outcomes. For more information about the initiatives and upcoming events by the Lagos Business School Sustainability Centre, please contact sustainabilitycentre@lbs.edu.ng. Together we can work towards a sustainable future for businesses on the continent. See our programmes at https://lbssustainabilitycentre.edu.ng/training

Shared Value Africa is the regional partner of the global Shared Value Initiative. Operated by Shift Impact Africa Group, a Shared Value consultancy, advocacy and training firm based in Johannesburg, its purpose is to grow the community of African Shared Value leaders. Shared Value Africa has been at the forefront of championing Creating Shared Value (CSV) on the continent via policies and practises that enhance the competitiveness of organisations while simultaneously advancing the economic and social conditions in the communities in which they operate. For more information, visit svai.africa.

Business

No System Upgrade Ongoing, All Operational Systems Functional, FirstBank Clarifies

Leading financial institution, FirstBank of Nigeria Limited, has debunked a misleading report circulating in the media regarding a system upgrade at FirstBank, saying that no such upgrade is underway and that all operational systems are functioning maximally.

The management of the bank made this clarification in a statement made available to this medium.

The statement reads in full:

We wish to address a misleading report circulating in the media regarding a system upgrade at FirstBank.

The message which was incorrectly interpreted and reported was sent to, and intended for our vendors only and focused on transitioning from our current I-Supplier Platform (our automated platform that connects us to suppliers) to a new Cloud-based Supplier Platform (worldclass platform for managing suppliers), to enable additional capabilities and benefits for our vendors.

Please be informed that no system upgrade is currently underway, and all our customer applications are fully operational. We are not experiencing disruption to our services, and our banking systems, customer transactions, channels, etc, will not be affected by the enhanced supplier platform.

Rest assured that our commitment to seamless service delivery remains unwavering as you continue to enjoy uninterrupted access to our services.

Business

Q3 2024: UBA Grows Net Interest Income by 149%, PBT up by 20% to N603bn

Riding on its recently released half-year financials, Africa’s Global Bank – United Bank for Africa (UBA) Plc, has announced its unaudited results for the third quarter ended September 30, 2024, where it recorded strong and impressive growth across all its key indicators.

As in the first two quarters of the current fiscal year, the bank’s gross earnings grew significantly by 83.2 per cent to N2.398 trillion up from N1.308 trillion recorded in September last year, while its net Interest income which stood at N443.0 billion at the end of the third quarter in 2023, rose impressively by 149 per cent to N1.103 trillion in the period under consideration.

The bank’s financial report filed with the Nigerian Exchange Limited on Monday also indicated a 20.2 per cent increase in Profit before Tax (PBT) to close at N603.48 billion compared to N502.09billion recorded at the end of the third quarter of 2023, while profit after tax also rose remarkably by 16.9 per cent from N449.26 billion recorded a year earlier to N525.31 billion in the period under review.

As in the preceding two quarters this year, UBA continues to maintain a very strong balance sheet, with Total Assets rising to N31.801 trillion, representing a 54.0 per cent increase over the N20.653 trillion recorded at the end of December 2023, just as the bank benefitted largely from its technology-led initiatives targeted at improving customer experience over the past few years, with Total Deposits rising to N26.50 trillion, representing a 52.7 per cent rise, up from N17.355 trillion at the end of the last financial year.

UBA shareholders’ funds remained very strong at N3.585 trillion up from N2.030 trillion recorded in December 2023, again reflecting a strong capacity for internal capital generation and growth.

Commenting on the result, UBA’s Group Managing Director/CEO, Mr. Oliver Alawuba, expressed pleasure that the Group continues to record strong and sustainable growth in its various revenue streams, building on its strong performance earlier in the year.

“The UBA Group achieved a profit before tax of N603.5 billion and our intermediation business continues to show strong growth with net interest income expanding by 149 per cent YoY to N1.10trillion and NIM closing at 8.03 per cent, which is 17.60 per cent above the 2023 position, despite persisting macroeconomic headwinds, geopolitical tensions, insecurity, inflationary pressure and exchange rate volatilities across our markets,” Alawuba stated.

According to the GMD, the Bank’s performance has been underpinned by consistent strong growth on all core and sustainable banking income lines, as he added that “Our substantial investments in technology are yielding tangible business value. This commitment is instrumental in delivering enhanced customer experiences and optimizing operational efficiency.”

The Bank’s Executive Director, Finance & Risk, Ugo Nwaghodoh, said, “I am delighted at the milestone reached in driving operational efficiency, reflected in cost-to-income ratio normalizing around the 50 per cent range. Shareholders’ funds recorded a 77 per cent growth from N2 trillion at FYE2023 to N3.59 trillion demonstrating the Group’s significant capacity for future growth.

On plans to consolidate its performance for the rest of the 2024 financial year and beyond, Nwaghodoh said, “We remain on track with various strategies to optimize our cost of funds and operating expenses. Furthermore, the Group has finalized plans to shore up its share capital to support its medium to long term aspirations, whilst aligning with the recent regulatory requirement in Nigeria and other jurisdictions.”

On plans to consolidate its performance for the rest of the 2024 financial year and beyond, Nwaghodoh said, “We remain on track with various strategies to optimize our cost of funds and operating expenses. Furthermore, the Group has finalized plans to shore up its share capital to support its medium to long term aspirations, whilst aligning with the recent regulatory requirement in Nigeria and other jurisdictions.”

He explained that UBA remains committed to sustainable growth in its core banking revenue lines and maintaining its strong compliance and risk management culture, even as the Group identifies further opportunities to expand.

United Bank for Africa Plc is a leading Pan-African financial institution, offering banking services to more than forty-five million customers, across 1,000 business offices and customer touch points in 20 African countries. With presence in New York, London, Paris and Dubai, UBA is connecting people and businesses across Africa through retail, commercial and corporate banking, innovative cross-border payments and remittances, trade finance and ancillary banking services.

Business

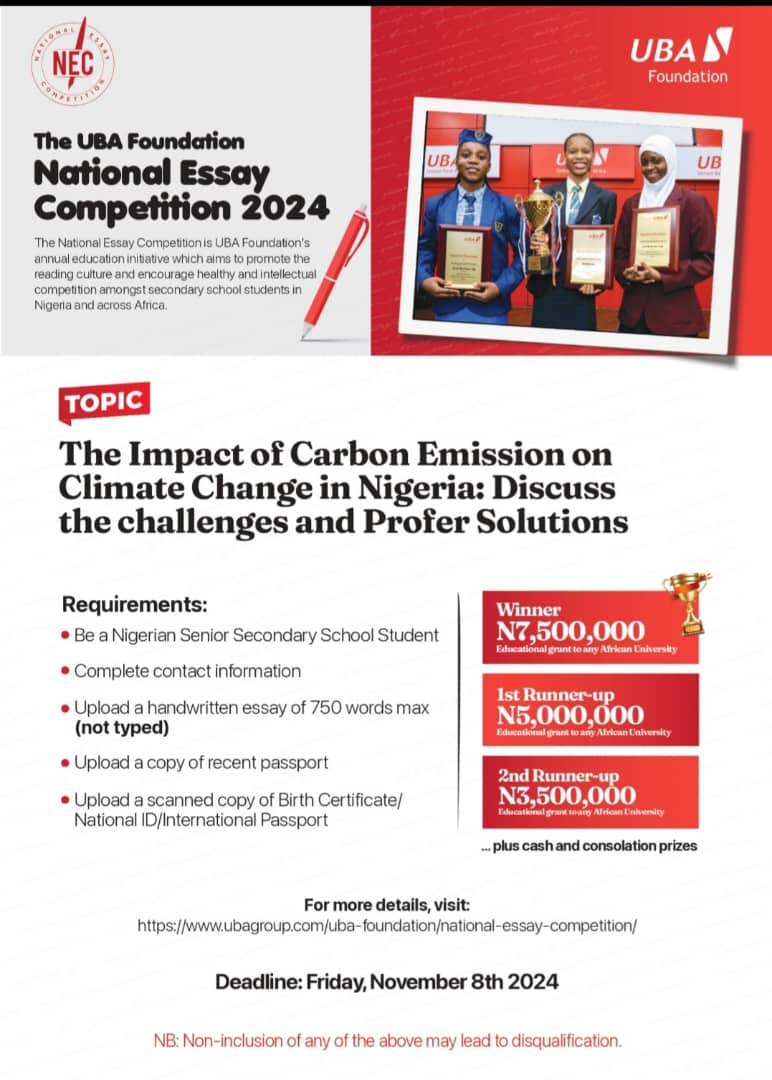

UBA Foundation Commences 2024 National Essay Competition for Youths

UBA Foundation, the Corporate Social Responsibility arm of the United Bank for Africa (UBA) Plc, has announced the commencement of the 2024 edition of its annual National Essay Competition (NEC) with a Call for Entries in Nigeria.

Now in its 14th year, the annual National Essay Competition (NEC) is part of the UBA Foundation’s education initiative aimed at championing literacy and encouraging intellectual development among senior secondary school students across Nigeria and the African continent.

The 2024 edition will see increased participation from senior secondary school students across Nigeria as they can conveniently submit their entries from the comfort of their homes or schools via the UBA Foundation NEC digital submission portal at www.ubagroup.com/uba-foundation/national-essay-competition

The essay topic for the call for entries is “Discuss the Impact of Carbon Emission on Climate in Nigeria: Challenges and Solutions”. Students are expected to properly research, write, scan and upload their handwritten essays to the digital portal on or before November 8, 2024.

The essays will be graded by renowned English professors who will then select the best 75 entries, which will be rewarded with N75,000 cash. A second competition will be held across four regions in Nigeria – Abuja, Enugu, Lagos and Port Harcourt where the 75 candidates will compete to be one of the 20 finalists. These 20 finalists will thereafter write a third essay where the top three will be selected.

The Foundation has also announced a substantial increase in educational grants as the first-place winner will receive N7.5 million to study at any African university of their choice, while the second and third-place winners will receive N5 million and N3.5 million, respectively.

The Chief Executive Officer, UBA Foundation, Bola Atta, who spoke ahead of the flag-off of this year’s completion, noted that despite the current global economic challenges, UBA Foundation remains steadfast in their commitment to educational excellence by significantly increasing the grant prizes this year

“We are aware of what families and parents are going through especially in the face of the current economic climate in Nigeria, and by raising the first-place prize to N7.5 million, with N5 million and N3.5 million for second and third places respectively, we are making a bold statement about our dedication to African education. The increase in grant prizes reflect our understanding of the rising costs of quality education and our determination to ensure that exceptional students can pursue their academic dreams without financial constraints.” Atta said

Apart from the 75 best essays, the 20 finalists will go home with brand new Laptops and other educational tools to help them with their studies and other tertiary research work. Also, the teachers of the school with the highest number of entries will be rewarded.

Atta pointed out that professors from leading Nigerian universities will serve as judges to evaluate the entries at all levels, to ensure fairness and transparency.

Speaking on the foundation’s unwavering commitment to development across Africa, Bola Atta, reiterated that NEC is a testament to UBA Foundation’s broader education initiatives, which include the ‘Read Africa’ program, which has distributed hundreds of thousands of books to students across the continent.

“The competition stands as a beacon of our commitment to nurturing Africa’s next generation of leaders and thinkers,” Atta said. “Through initiatives like this and our ‘Read Africa’ program, we’re not just promoting literacy; we’re investing in the intellectual capital that will shape Africa’s future”

The National Essay Competition has been rolled out in other African countries where UBA operates, in order to open up the opportunity for more African children to benefit from the educational grants.

UBA Foundation embodies the UBA Group’s CSR objectives and seeks to impact positively societies through several laudable projects and initiatives. Through its Education pillar, the Foundation has donated hundreds of thousands of books to students across Africa under the ‘Read Africa’ initiative aimed at encouraging and promoting the reading culture in African youths. Its National Essay Competition has also afforded the opportunity to hundreds of students to improve their lives through higher education.