Personality in Focus

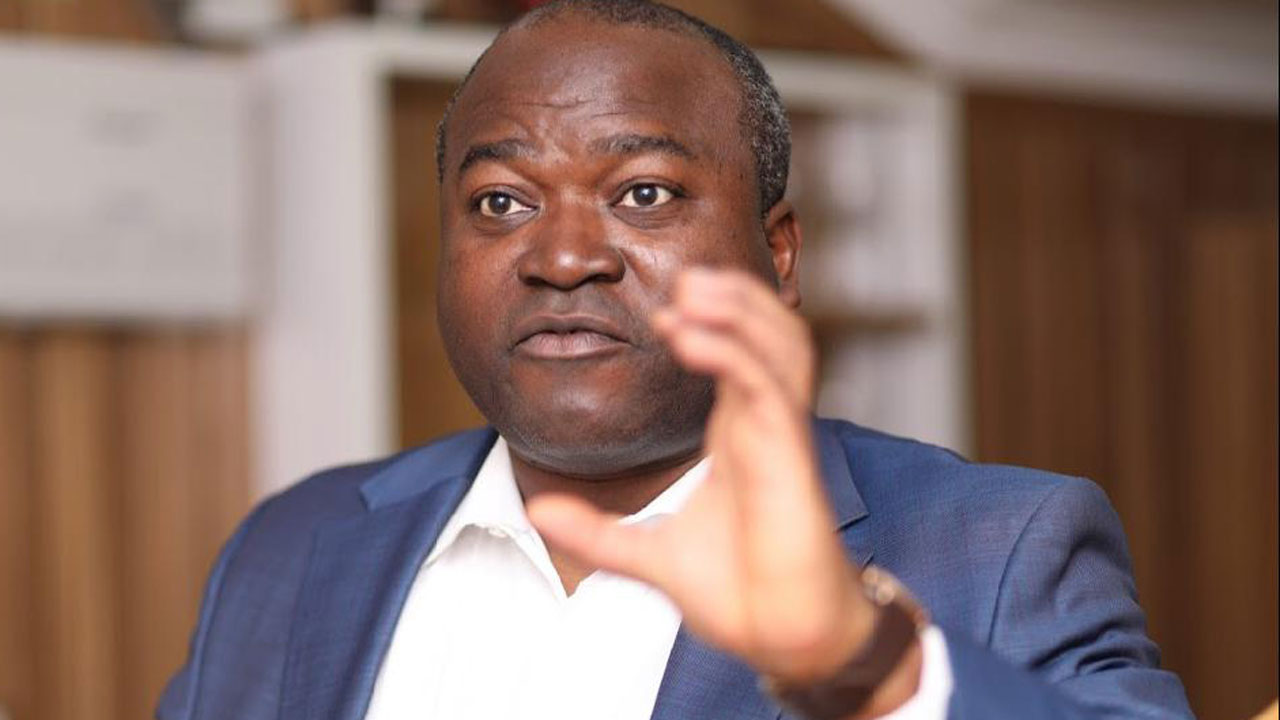

Why Marigan Space Leads Investments, SME Loans, Savings Schemes – CEO, Saheed Abodunrin

By Eric Elezuo

The microfinancing business is gaining grounds in Nigeria, in a bid to assist petty traders and SMEs to find their foot in the ever competitive entrepreneurial environment. Among the firms which has taken it upon themselves to see that thriving businesses grow in the country is Marigan Space. In this interview, the Chief Executive Officer, Saheed Abodunrin speaks on the features that set the firm apart from the rest.

Could you give a brief background of your person, taking into cognizance your birth, education, career progress among other things

My name is Saheed Abodunrin. I was born on January 2, 1991 in Oyan town, Osun State to parents I am ever so proud of because of their efforts in going the extra mile for me and my siblings. At the age six, I began my academic sojourn, and consistently laboured through the nursery, elementary, secondary and tertiary institutions to come out fully baked, and equipped to give back my quota to the socio-economic development of the world beginning with my country, Nigeria.

Consequently, I had my nursery, primary and secondary school education in Idiroko, a border town in Ogun State, after which I attended the prestigious University of Lagos with a Diploma Certificate in Physics, and subsequently a Bachelors of Science degree in Geography and Planning in 2010.

I attended SS International Nursery and Primary School and Ojumo Community High School for secondary school before proceeding to the University of Lagos.

Thereafter, there was no looking back, as I immediately ventured into entrepreneurship, running low scale businesses until in 2018 when I finally registered Marigan Space Limited after meeting all requirements to start up a non-bank financial firm.

How did the name Marigan Space come about and what actually prompted your choice of career considering the fact that you studied science related courses?

Marigan Space Limited, with registration identity, RC1481308 is an African leading Investment and non-Bank micro-finance Institution that deals in SME’s Savings and Loans with interest in Agriculture, Real Estate and General Merchandise. Yes, most of the times, we study a particular course, but our passion is domiciled in something. Personally, I have a knack to see people grow and become their own bosses, and the only way I know I could make it come to pass is taking up the mantle of assisting them to grow through loans and other related activities.

Going a little more detailed, the name MARIGAN was coined from the names of my late Mother, Mariam, and my father, Ganiyu, I added Space, hence Marigan Space Limited. I have nursed the vision of starting up a financial firm as far back as my early days in secondary school, at just the age of 12. It must interest you to know that I am from an average family in Idiroko, a border town in Ogun state. My father, Alhaji Ganiyu Raji Abodunrin was a licensed Customs agent while my mother, late Mrs. Mariam Abodunrin was a trader who sells cement, engine oil and stationeries. I was therefore, involved in keeping financial records from both sides. My mother was also involved in different thrifts (esusu), and as a group leader. She was actually the first person to engage me with financial record keeping and disbursement of funds to various members. This, I did passionately. From that earliest experience, which I developed overtime, I automatically became a defacto financial record keeper, albeit diligently in every association, club or society I found myself as the days of growing up progress.

Furthermore, I have been involved in different endeavours including recharge card sales, showbiz, car importation, sales of computer accessories and goods delivery services. I also have a hand in media and PR with Crystals Media Empire, CME.

The year 2016 however, marked a turning point in my life. It was the year I returned to what I know best – finance. I attended few courses, and thereafter registered Marigan Space Limited. With support from family and friends, I was able to raise the initial capital and the rest, as they say, is history.

What are the major objectives of your organization?

Like I mentioned earlier, I was introduced into this business primarily because of my passion to see Nigerians grow in their businesses, become their own bosses and employ others. By so doing, the cycle continues to a stage where the dependency ratio will be greatly minimised. However, it will be pleasure to itemise some of what what we stand for as follows:

-To create value for our shareholders and maintain it over the long-term.

-To meet the needs of customers in simple, flexible and creative ways.

-To provide our investors with sound investment advice, drawing on the strength of our experience and knowledge, while keeping abreast of the latest financial sector developments.

-To be a successful Investment and financial firm through the application of the highest professional standards, drawing on our experience and adhering to our organizational values.

What is your involvement like with organization such as the CBN and other financial regulatory bodies?

Well, in truth, you can’t run a finance institution without a recourse to the Central Bank of Nigeria either directly or otherwise. As a result, our involvement and relationship with CBN and other financial bodies have remained very cordial. They are our regulators and we abide by laid down rules and procedures. We are registered members with Association of Non-Bank Micro Finance Associations in Nigeria (ANMFIN), Certificate of registration with EFCC SCUML and many more. We have all our registrations intact because we know the sanction grid of non-compliance, so we don’t want to fall a victim.

How successful could you say Marigan Space Limited is at the moment?

Honestly, it is not just about the success of Marigan Space, but about the quest to put smiles on the faces of business owners and would-be business owners. Their success determines out fulfilment. So I’d say we have been able to reach out to thousands of low-income customer segment because we understand that in this part of the economy, the market is still largely untapped. Tapping this large unbanked segment is proving to be a tremendous growth driver for Marigan Space. We have also expanded our portfolios by extending our services to real estate, agriculture and FMCG. Over time, Marigan space limited has gained expansion in her business despite the economic recession. It has increased her turnover to over 58.27%, while her customer’s strength has risen to 8,967 people within our area of coverage. So the more our customers are expressing confidence and joy, the more successful I would say we have been.

And as part of our endeavours, by mid-2021, Marigan Space, which is also in the real estate business, acquired over 603 plots of land duly registered and will be ready for sale to the general public, especially our existing customers in no distance time. Our poultry farm is at 74% completion and hope to start production with at least 5,000 broilers by the beginning of second quarter in 2022. All these are about having the interest of Nigerians at heart.

What or who are the targeted clientele and beneficiaries of your organization and its products?

The concept of Marigan Space Limited is open to Nigerians of all levels. But as time goes on with the increase in awareness and technology of the brand, we start to have customers from the high earned, the high net worth individual as well as few blue chips in the society.

Micro financing or micro lending is all about lending or support to the low income traders in bringing their businesses to a stable level with low interest rate which comes in a single digit. Moreover, the only way Marigan Space can help the government in increasing the country’s Gross Domestic Product (GDP) which the petty traders are one of the main contributors is to support them financially. So, our main target and client beneficiaries are mainly the micro, small and medium scale enterprises and entrepreneurs, which include market men/women, taxi drivers, men and women in agriculture and the artisans. The salary earners are not left out because about 25% of our loan investment are always set aside for this class so as to alleviate poverty.

We are also have expertise in forecasting the world economy to suit investors in terms of good Return on Investment (ROI) and this has been making the brand a preferred one over the years. Our investment platform is opened to the general public.

Does Marigan Space have any app or intend to develop any app to reach out to clients easily?

Although we are working towards developing our user friendly mobile Applications for both Android and IOS users in the nearest future but we do have a website www.mariganspace.com with a live customer care ready to assist users with answers to questions about Marigan Space. Our mobile application platform will be able to perform monetary transaction seamlessly.

What problems or challenges have your organization or your services and products helped to solve in the Nigerian economic environment?

Our mission as an Investment and financial company is to help our client (customers) eliminate the gap between their present position financially in business and their target in being in business. Moreover, for Marigan Space Limited to succeed, we work with market men and women, farmers, transporters and investors to establish, improve and implement long term management plan that make it possible for them to attain their financial purpose. Our investment and loan plan is customized for each investor and customer. As an investment and financial institution, we strive hard to give our customers and investors a long term performance despite the economic recession. We assure investors wealth perform in the best way essential to their unique goal while making sure that our customers remain in business with maximum returns.

Furthermore, the MSME space of Marigan Space Limited has helped not less than 5,000 business owners since our establishment in 2018. We make available soft loans to them and pay back accordingly to their income cycles (daily, weekly and monthly etc). Also, we have provided lots of food items in compensation for both businesses and salary earners. We also provide shelter for so many and we make the payment structure easy, just as there is flexible payment plan for sales of land, overtime. Presently, we have over 1,000 plots of lands, accessible to our customers at the beginning of business year in 2022.

Where do you see your organization in the next five years, or rather on its tenth anniversary?

Next Five years?….well, for those that knows the management structure of Marigan Space Limited, they will know that “FOCUS” is our watch-word. We would have been upgraded to a full banking institution by attaining the minimum capital base of a National Microfinance bank as speculated by the CBN and branch offices outside Nigeria. We are still thriving and open to local and foreign Investors in order to achieve this dream; and in the nearest future, we should be trading in the Stock Exchange Markets. As you already know, we have diversified our interest into Agriculture, Real Estate, FMCG and IT.

What does a client stand to gain by doing business with Marigan Space?

Clients gain a lot because we are a very selfless firm. We put our clients first in the scheme of things. We listen to them, understand their needs, understand their cash flow and advise accordingly. They always come back to give a firm thank you hand shake. Clients also get good security on their investment with a high Return on Investment (ROI) of up to 45% in 36 months.

How do you think Nigerian can stop the free-fall of the Naira as a finance expert?

The answer to this question is very wide. It is pertinent to examine and evaluate the cause of a problem and know the right way to solve it. However, to keep this simple, the principle of demand and supply can work in this direction. Re-decimalization can also increase the value.

Again, we can regulate our price control and encourage local production.

Many small businesses are finding it difficult to survive as a result of high interest rates on loan. How does your organization bridge this gap and assist SME’s to thrive?

Well, there is what we call cost of fund, cash reserve ratio and liquidity ratio. Not to go into details, the cost of purchase determines the cost of sale of fund. However, we try to balance it at least to make a little margin. We also collateralize our loans using the formula of 5C’s of lending.

Tell us how you have been able to run your company successfully in the face of the dwindling economy?

The economy has really been dwindling and we have been in the storm and pray that it can only get better. However, like I said earlier, businesses in some sectors are still thriving like FMCG, Health and Agriculture, we position to those sectors and somehow, we have been surviving.

How do you relax as in your favorite food, sports, attire?

I relax by reading books of successful entrepreneurs; the likes of Bill Gates, Warren Buffet, Jack Ma and others. I am not a television freak so I watch less of TV, but I enjoy hanging out with friends. Notwithstanding, I love sports and football is my number one.

Personality in Focus

Lagos Police Celebrate Ayo Ogunsan on Appointment As LSSTF Boss

The Lagos State Police Command, under the leadership of the Commissioner of Police, CP Olohundare Jimoh, has extended its heartfelt congratulations to Dr. Ayo Ogunsan on his well-deserved appointment as the Executive Secretary of the Lagos State Security Trust Fund (LSSTF).

In a statement signed by the Command’s Public Relations Officer, SP Abimbola Adebisi, and made available to the National Association of Online Security News Publishers (NAOSNP), the command noted that “Dr. Ogunsan’s appointment is a clear testimony to the unwavering trust and confidence that the Governor of Lagos State, Mr. Babajide Sanwo-Olu, has in him.”

Reminiscing Ogunsan’s trajectory in the world of administration and security, the statement stressed that “Over the years, Dr. Ogunsan has demonstrated exceptional selflessness and commitment to strengthening the security architecture of Lagos State.”

The Command further noted as follows:

“The Commissioner of Police is confident that Dr. Ogunsan, as a distinguished member of the LSSTF Board, will assume this new role with deep institutional knowledge, proven integrity, and unwavering dedication, coupled with a strategic understanding of the security needs of Lagos State. The Command has no doubt that he will deliver on his mandate successfully.

“Dr. Ogunsan’s continued valuable contributions to the LSSTF and his longstanding partnership with security agencies across the State have positioned him exceptionally well to steer the Fund towards greater operational efficiency, an outcome that will undoubtedly enhance public safety and security throughout Lagos State.

“The Lagos State Police Command once again warmly welcomes his appointment with deep optimism and hereby assures the new Executive Secretary of its unwavering partnership and cooperation. The Command is proud of him and immensely happy to be associated with him.

“The Lagos State Police Command looks forward to further strengthening the existing synergy, support, and operational collaboration with Dr. Ayo Ogunsan and the LSSTF team in ensuring the continued safety and protection of all residents and visitors in Lagos State.”

Prior to his appointment, Ogunsan was a Board Member of the Trust Fund.

Personality in Focus

COAS Shakes Up Army Hierarchy, Appoints New Principal Officers, Commanders

The Chief of Army Staff (COAS), Lt. General Waidi Shaibu, has approved the appointment of some senior officers to top strategic command and positions, aimed to strengthen command structures and reposition the Nigerian Army for heightened operational effectiveness.

According to a statement by Army’s spokesperson, Lt.-Col. Apollonian Anele, on Thursday, the appointment cut across key command, staff and instructional positions across formations, units and training institutions of the Army.

Among the new appointees are: Major General Bamidele Alabi, who has been redeployed to Army Headquarters Department of Policy and Plans and appointed Chief of Policy and Plans (Army); Major General Jamal Abdulsalam, formerly Chief of Special Services and Programmes at Army Headquarters proceeds to Defence Headquarters Department of Operations as Chief of Defence Operations while Major General Peter Mala moves from Office of the National Security Adviser to Headquarters Training and Doctrine Command Nigerian Army (TRADOC) as Commander.

Major General Samson Jiya, from Nigerian Army Heritage and Future Centre (NAHFC) moves to Defence Headquarters Department of Defence Accounts and Budget as Chief of Defence Accounts and Budget.

Other strategic appointments include, Major General Mayirenso Saraso from NAHFC to Army Headquarters Department of Operations as Chief of Operations (Army); Major General Isa Abdullahi from Defence Headquarters to Army Headquarters Department of Administration as Chief of Administration (Army); Major General Musa Etsu-Ndagi from Army Headquarters to Department of Training to Army Headquarters Department of Civil-Military Affairs as Chief of Civil-Military Affairs. Major General Abubakar Haruna from NAHFC to Nigerian Army Training Centre (NATRAC) Kontagora as Commander and Major General Philip Ilodibia from Army Headquarters Department of Policy and Plans to Defence Space Administration as Chief of Defence Space Administration.

Others are: Major General Godwin Mutkut, from Multi-National Joint Task Force (MNJTF) N’Djamena to Headquarters Infantry Corps Centre as Corps Commander Infantry, Major General Umar Abubakar from the Ministry of Defence to Headquarters Nigerian Army Armour Corps as Commander Armour Corps, Major General John Adeyemo moves from Nigerian Army School of Artillery (NASA) to Headquarters Nigerian Army Corps of Artillery as Corps Commander Artillery and Major General Mohammed Abdullahi from Nigerian Army Cyberwarfare Command to Headquarters Nigerian Army Signals as Corps Commander Signals.

Also, Major General Taofik Sidick has been redeployed from the NAHFC to Headquarters Nigerian Army Finance Corps as Chief of Accounts and Budget (Army), Major General Abdullahi Ibrahim from NAHFC to Headquarters Nigerian Army Ordnance Corps as Corps Commander Ordnance, Major General Adeyinka Adereti from Defence Headquarters to Headquarters Nigerian Army Electrical and Mechanical Engineers as Corps Commander, Major General Nansak Shagaya from Army Headquarters Department of Operations to Headquarters Nigerian Army Corps of Supply and Transport as Corps Commander Supply and Transport while Brigadier General Yusha’u Ahmed has been appointed acting Corps Commander Education.

The COAS also approved the appointment of Major General Oluyemi Olatoye, from Headquarters 82 Division/ Joint Task Force South East Operation UDO KA to the Nigerian Defence Academy (NDA), Kaduna and appointed Commandant, Major General Emmanuel Mustapha from Defence Space Administration to Nigerian Army Signal School as Commandant, Major General Adamu Hassan from Nigerian Defence Section, Riyadh, to Nigerian Army School of Artillery as Commandant and Brigadier General John Bulus from Headquarters Nigerian Army Finance Corps to Nigerian Army School of Finance and Accounts as Commandant.

According to the statement, the senior officers appointed as field commanders includes, Major General Saidu Audu from Army Headquarters Department of Training to Multi-National Joint Task Force (MNJTF), N’Djamena, as Force Commander, Major General Warrah Idris from Defence Headquarters to Joint Task Force North West Operation FANSAN YAMMA as Commander and Major General Oluremi Fadairo from Army Headquarters Department of Civil Military Affairs to 82 Division Nigerian Army, Enugu as General Officer Commanding and Commander Joint Task Force South East Operation UDO KA.

Other appointees are Major General Olatokumbo Bello as the Director Defence Media Operations at Defence Headquarters while Brigadier General Samaila Uba was redeployed from the Armed Forces Command and Staff College Jaji to Defence Headquarters as Director Defence Information.

The CIAS charged the new appointees to bring to bear their wealth of operational experience, administrative acumen and strategic foresight in driving a disciplined and combat-ready Army to decisively confront the contemporary and emerging security challenges.

He urged them to sustain the current operational momentum, strengthen interagency collaboration and remain unwavering in upholding the Nigerian Army’s core ethos of loyalty, selfless service, integrity and excellence.

Personality in Focus

Runsewe Bags ‘Pillar of Nigerian Tourism and Culture’ Award

Former Director General of the National Council for Arts and Culture (NCAC) and the Nigerian Tourism Development Authority (NTDA), Otunba Segun Runsewe, has bagged the award of Pillar of Nigerian Culture and Tourism.

The award was conferred on him by the Association of Nigerian Journalists and Writers of Tourism (ANJET), the umbrella body for Nigerian travel press, on Thursday, October 23 at a colourful ceremony held at the prestigious Sheraton Lagos Hotel and Towers.

He was among some distinguished Nigerians from public and private sectors, including the former Nigerian Minister of Tourism and Culture, Ambassador Frank Ogbuewu, who were honoured for their contributions to the growth and development of Nigerian tourism.

Other distinguished Nigerians conferred with awards were: Otunba Wanle Akinboboye (Foremost National Tourism Builder and Creative Mind), Mr. Jemi Alade (National Trailblazer in Inbound Tour Operation) Engineer Tarzan Ganiyu Shekoni Balogun (National Icon in Tourist Boat Operations and Water Transportation), Mr. Nkereuwem Onung (Icon of Consistency and Resilience in National Tourism Leadership), and Chief Abimbola Bode-Thomas (Hospitality and Tourism Management Amazon).

Speaking on the award conferred on Runsewe and the other awardees, the President of ANJET Mr. Okorie Uguru said the awards aim to promote the culture of service to the people, and also showing appreciation to those who have served the nation with distinction while holding public office.

He said: “It is not about celebrating those who are serving the country now, but showing appreciation to those who have served in the past, to challenge current political office holders to put in their best.

“The individuals and distinguished Nigerians we are honouring are among the people that built the visibility and growth the tourism industry is enjoying today… They have contributed, and are still contributing to the sector.

“As holders of institutional memories and archivists of this industry, we know the roles they have played and are still playing in the development of the Nigerian tourism industry. That is why years after some of our awardees have left public offices, we still call them to bestow this honours.”

While receiving the award, Runsewe lamented the inability of Nigeria to take tourism seriously. He said: “I stopped talking for some time because there are too many talks in tourism, there is no action. We come; we speak big English and go back. Today, I am going to reveal two or three things. The last time I came out was to speak to the new executives of the Federation of Tourism Associations of Nigeria (FTAN). For me, I am almost tired of talking, because there is no action.

“Let me first of all thank Ambassador Ogbuewu today. He said he does not want to come, so I urged him to come. It is only the living that can be celebrated. Let us thank God that during our lifetime, we are being celebrated. It is not everybody that has that opportunity.

“I can stand anywhere and talk about this industry. I do not need a book.

“Ambassador Ogbuewu you would recollect that President Obasanjo took your very good self, led a delegation to Trinidad and Tobago. That was the day Obasanjo made a statement, he said ‘I going to stand on the existing protocol’. That was the first time they heard that English. The then president of Trinidad asked, ‘what is he talking about.’ That is a tourism brand.

“People do not understand tourism yet. People think it is only about moving from one place to the other. No. Let me reveal a few things: how many of us know the late Pastor T.B. Joshua. T.B. Joshua was selling religious tourism and nobody keyed into it? When T. B. Joshua was having his conference in Nigeria, there were over 20 private jets parked at the airport. I, maybe you did not know before today, I normally go to the airport to list how many countries they come from. I have my data. There is religious tourism in Nigeria. We have not tapped into it. We see them as pastors. Yes, pastors doing their job, but there is tourism content in what they are doing.

“If this country manages tourism well, we should not have a single child looking for a job. After agriculture, tourism is the biggest employer of labour, but we are still playing games, we are still telling ourselves stories.”

He thanked ANJET for the award and encouraged them to continue with the good work in the industry.